Wells Fargo said in their August financial technical report that they “As a consequence of the Federal Reserve’s hawkish stance, dollar momentum is expected to persist through the final leg of 2022. We now anticipate the dollar might reach its top in Q4 2022 “.

Wells Fargo said in their August financial technical report that they “As a consequence of the Federal Reserve’s hawkish stance, dollar momentum is expected to persist through the final leg of 2022. We now anticipate the dollar might reach its top in Q4 2022 “.

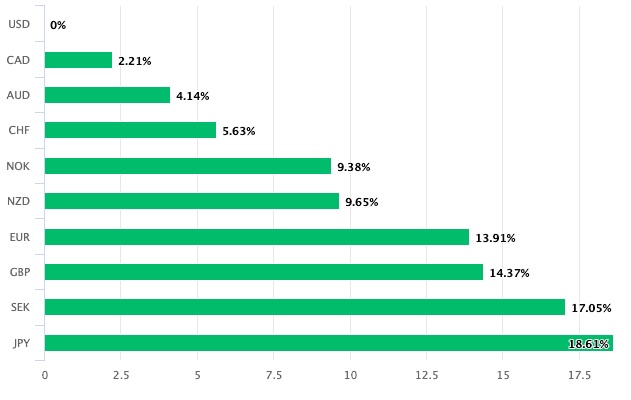

A check at the US Dollar index (DXY), a performance indicator for the USD, reveals that the currency has been on an upward trend since May 2021: Forecasts that the U.S. Federal Reserve would lead worldwide central banks in a rush to increase interest rates in response to surging prices, concluding in a sequence of outsized 75 basis point rises in 2022, have fueled the Dollar’s long-term upswing.

Nick Bennenbroek, International Economist at Wells Fargo Economics, predicts that the US currency will rise somewhat through the end of the year when the Fed increases interest rates by 75 basis points in September and officials reiterate their hawkish position at the Jackson Hole Annual Symposium.

The capital systems expect the Fed to tighten monetary policy by approximately 62.5 basis points in September, thus Wells Fargo’s prediction of a 75bp increase is a hawkish measure.

“Because markets are underbidding the FOMC meet in the upcoming month, we expect the dollar will appreciate until the end of the third quarter of 2022 as financial markets respond to a 75 basis point rate rise by the FOMC in September,” Bennenbroek explains.

In this case, the Pound to Dollar exchange rate might remain under 1.19 and the Euro to Dollar conversion rate could remain below parity. The experts at Wells Fargo now anticipate that the Eurozone will have an economic contraction in the fourth quarter of 2022.

“We still anticipate a recession in the United Kingdom, Mexico, and Brazil, and we maintain that the United States will enter recession by the beginning of 2023,” adds Bennenbroek.

It is difficult to be positive about Sterling and the Euro under these conditions. Wells Fargo thinks that the Bank of England can increase interest rates more, but not as much as the prevailing market forecasts. According to Bennenbroek, “We predict the BoE will raise benchmark rates to 3%, while market players anticipate a terminal rate nearer to 4%.”

Equally applicable to the European Central Bank (ECB). “Markets possibly overpricing overseas central bank policy tightening from institutions such as the Bank of England and the European Central Bank may function as a tailwind for dollar gains until the end of the 2022,” adds Bennenbroek.

“As recession concerns in Europe become very obvious and acknowledged by investors, the quantum of tightening that market players may anticipate from the Bank of England and the European Central Bank might diminish. This revaluation should cause the British pound to lag and the euro to slide further below parity versus the U.S. dollar over the coming couple of quarters ” he continues.

In 2023, when the impact of inflation subsides, it is anticipated that all central banks would reduce their interest rates once again. Importantly, the Fed will lower rates more quickly, and this should spark a larger retreat in the U.S. dollar.

“While we also expect rest of the top central banks to loosen monetary policy in 2023, we think the Federal Reserve will likely reduce policy rates more rapidly. With rate differentials reversing in favor of overseas currencies in 2023, the dollar could undergo a cyclical drop versus the majority of G10 currencies and several emerging market currencies ” says Bennenbroek.

The GBP/USD, according to Wells Fargo’s projections, will reach 1.1400 by the end of this year, 1.1500 by the final leg of the first quarter of 2023, 1.1600 by the end of the second quarter, and 1.1700 by the end of the third quarter. Their EUR/USD prognosis profile indicates a value of 0.9600 for the end of the year, 0.9700 for the end of the first quarter of 2023, 0.9800 for the end of the second quarter, and 1.00 for the end of the third quarter.

A year from now, the current sideways drift between the British Pound and the Euro is anticipated to still be present, according to the profile shown above. The expected range for the British pound to Euro is 1.1875, 1.1855, 1.1836, and 1.17.