Following the announcement of unexpectedly robust US data, the British Pound came under substantial pressure versus the Euro and the US Dollar just before the weekend. Regardless of a series of activity-restricting interest rate rises by the US Federal Reserve, January employment and survey statistics revealed that the US economy was in unexpectedly good form.

Following the announcement of unexpectedly robust US data, the British Pound came under substantial pressure versus the Euro and the US Dollar just before the weekend. Regardless of a series of activity-restricting interest rate rises by the US Federal Reserve, January employment and survey statistics revealed that the US economy was in unexpectedly good form.

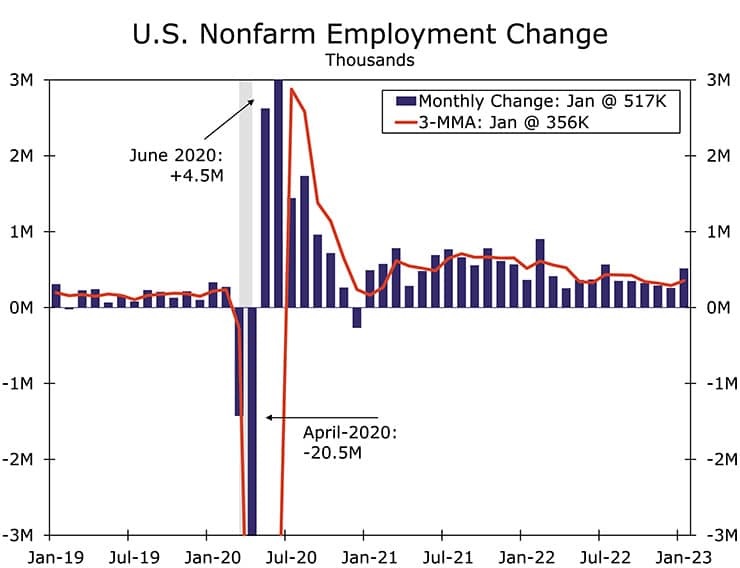

Obviously, a better-than-anticipated gain in nonfarm payroll employment in January – 517K jobs were added, as per nonfarm payroll data – implies that the Fed will be required to boost interest rates in order to contain inflation. The employment data bucked predictions of an 185K gain in jobs and was much higher than December’s 260K rise. As investors believed that benchmark interest rates would be required to rise more than anticipated, stock markets declined, strengthening the Dollar and exerting more pressure on the Pound.

As of February 03, the Pound is a “high beta” asset that seems to lag the Dollar and Euro when markets are sliding. While preparing this article , the currency exchange rate between the British Pound and the United States Dollar is 1.21, a decline of one percent on the day.

The current Pound to Euro conversion rate is 1.1168, a decrease of 0.3%. “The US dollar rose after a shockingly and resoundingly upbeat employment data lent credence to the Fed’s argument that it would continue to raise interest rates,” says Joe Manimbo, Senior Markets Analyst at Converge. The Euro/Dollar exchange rate has declined 0.80% to 1.0845. The employment report stated that the unemployment rate in the United States declined from 3.5% to 3.4%, contrary to forecasts that it would climb to 3.6%.

In line with forecasts, the average hourly wage grew 0.3% in January, while December’s result was revised up to 0.4%. Year-over-year profits decreased to 4.4% from 4.8%, however this was still higher than the market consensus of 4.3%.

Therefore, the labor market is “tight,” and employers are required to provide competitive compensation packages to maintain and recruit talent. This, in effect, supports domestically-stirred inflationary pressure and contradicts the Fed’s goal of reducing inflation.

The market’s expectation of a rate decrease by the end of the third quarter, as implied by the wager, will thus not materialize.

“We anticipate members of the Federal Open Market Committee will view January’s employment numbers with a dose of caution. However, it will be difficult for lawmakers to fully disregard the figure at a period when they want to guarantee that their actions contribute to a sustainable return of inflationary pressure to 2%” Wells Fargo analyst Sarah House said.

This increases US bond rates and draws money into U.S. assets, ultimately strengthening the Greenback. ISM economic survey data indicating that the U.S. services sector recovered substantially in January provided additional support for the pro-USD sentiment. The ISM Non-Manufacturing PMI came in at 55.2, above estimates of 50.4, as it rebounded from December’s contractionary 49.9 level.

If markets continue to decline because of concern of increased Fed interest rates, the Dollar might appreciate more. In the meantime, it is anticipated that the pound will come under increased strain.