TD Securities has joined the ranks of banks forecasting the Reserve Bank of New Zealand (RBNZ) to raise interest rates, adding momentum to the recent strength of the New Zealand Dollar.

TD Securities has joined the ranks of banks forecasting the Reserve Bank of New Zealand (RBNZ) to raise interest rates, adding momentum to the recent strength of the New Zealand Dollar.

In a research note indicating a change in its policy predictions for both RBNZ and RBA, TD Securities now anticipates interest rate hikes at the upcoming meeting and in May. This adjustment positions TD Securities as the second major bank, following ANZ, to caution that the central bank’s next move is likely to be a rate hike, a stance influenced by robust fourth-quarter employment figures.

This shift marks a notable change in assumptions about New Zealand’s interest rate trajectory, considering the recent consensus that the RBNZ was poised for a rate cut by mid-year. Prashant Newnaha, Senior Asia-Pacific Rates Strategist at TD Securities, highlights that doubts about the RBNZ starting an easing cycle were already present, but recent data, particularly the Q1 Household Inflation expectations release, has introduced additional complexities.

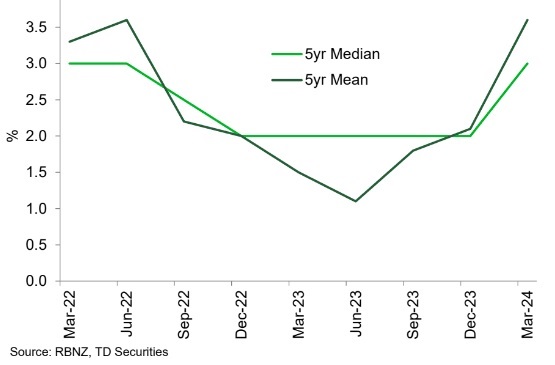

Newnaha points out key findings in the RBNZ’s report that suggest the need for more rate hikes to curb domestic inflation pressures:

One-year inflation expectations persist at 5% for three consecutive quarters.

Two-year expectations have risen to 3.2% from 3% in Q4’23.

Five-year inflation expectations surged by 1% from 2% in Q4’23 to 3%.

TD Securities emphasizes the significance of these findings, underscoring the RBNZ’s own acknowledgment of their credibility. The report reveals that using various forecasting models, the one-year RBNZ survey on household inflation expectations contributes significantly to predicting headline inflation.

New Zealand Dollar Resilience Expected with Interest Rate Surge

The unexpected surge in five-year inflation expectations is a cause for concern at the RBNZ, challenging the credibility of its inflation target. TD Securities anticipates a 25 basis points hike at the upcoming meeting and suggests the possibility of signaling further hikes, potentially leaving the RBNZ’s Official Cash Rate at 6.0%, the highest among G10 central banks.

A Shift in RBNZ Outlook Challenges Prior Rate Cut Expectations

While this scenario implies substantial support for the New Zealand Dollar through the interest rate carry channel, caution prevails as potential economic ramifications, such as stagflation (low growth, high inflation), may temper the currency’s appreciation, especially given New Zealand’s current technical recession.

In summary, TD Securities’ revised outlook aligns with a broader trend of anticipating RBNZ interest rate hikes, influencing the trajectory of the New Zealand Dollar and challenging prior expectations of a rate cut. The delicate balance between inflationary pressures and economic growth remains a crucial factor shaping the central bank’s future decisions.