As per the analysis of an investment bank, the British Pound has exhibited a 3.0% appreciation against the Euro in 2023, leading to the attainment of the highest exchange rate since December. The bank predicts that there will be additional gains in the future. Specifically, Credit Suisse’s strategic outlook on the British pound leading up to 2023 remained cautiously optimistic, which has resulted in a profitable outcome for the investment bank. This approach was unique among other major investment banks.

As per the analysis of an investment bank, the British Pound has exhibited a 3.0% appreciation against the Euro in 2023, leading to the attainment of the highest exchange rate since December. The bank predicts that there will be additional gains in the future. Specifically, Credit Suisse’s strategic outlook on the British pound leading up to 2023 remained cautiously optimistic, which has resulted in a profitable outcome for the investment bank. This approach was unique among other major investment banks.

During a recent client briefing, Shahab Jalinoos, who serves as the director of FX research at Credit Suisse in Zurich, indicated that the initial target for EUR/GBP at 0.8700 (GBP/EUR @ 1.15) has been surpassed. However, Jalinoos suggests that the pair may continue to decline as Sterling strengthens even more. Throughout the entirety of 2023, it has been one of our fundamental beliefs that the pricing of UK interest rates has been excessively lenient, given the evident price and wage pressures in the UK economy. The Bank of England (BoE) is a central bank that targets inflation as its primary objective. Currently, the inflation target remains at 2%, despite the United Kingdom having the highest inflation issue among the G10 nations, as stated by Jalinoos.

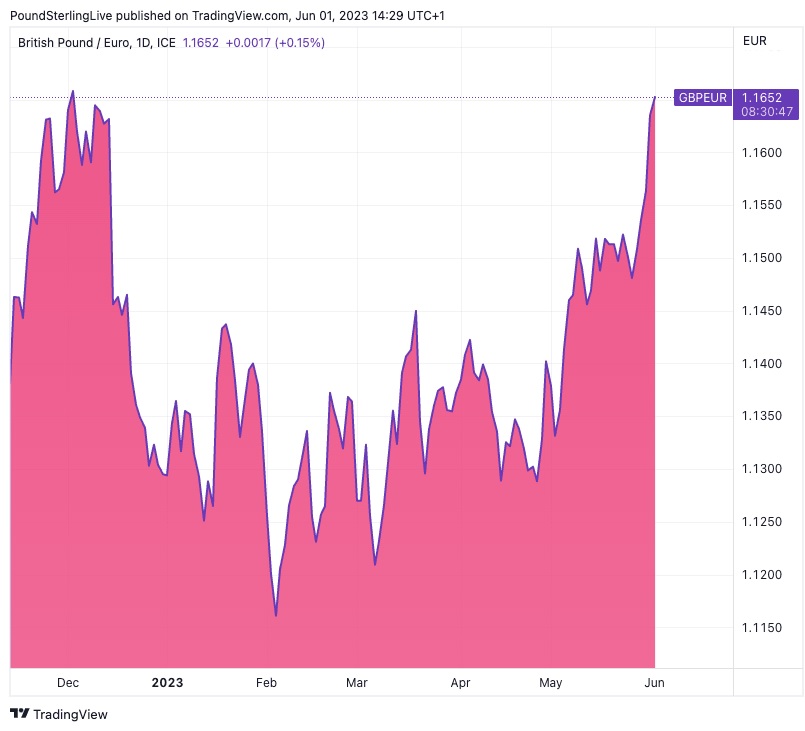

In the past few days, the Pound has experienced an upsurge against the Euro, reaching its peak level since December 2022 at 1.1650. This growth has been facilitated by the escalation of UK yields and the Eurozone’s underperformance in yields, which has been relatively lower due to the recent Eurozone inflation data that was softer than expected. The UK’s yields experienced a boost following the news from last week that the country’s inflation rate in April stood at 8.7% year-over-year, a significantly higher figure than what analysts had predicted.

On the other hand, the Euro currency has experienced a decrease due to the fact that the inflation rate in Germany for the month of May has fallen short of initial predictions by a significant margin, and France has also experienced a similar trend. Eurostat’s report on Thursday indicated that the area’s inflation is expected to have decreased to 6.1% in May from the previous 7.0%, due to a widespread moderation. This resulted in the annual rate of price growth falling below the consensus of economists, which was 6.3%. The core inflation rate, which is closely monitored by the European Central Bank, decreased from 5.6% to 5.3% in May. This figure was lower than the anticipated decrease of 5.5%, as estimated by economists.

As per Credit Suisse’s analysis, there seems to be a consensus between the UK Treasury and Bank of England regarding the imperative to curtail inflation. This indicates that the Bank of England’s intention to hike interest rates for mitigating inflation is unlikely to face significant political intervention.Given Chancellor Jeremy Hunt’s public endorsement of the imperative to reduce inflation, we maintain that the Bank of England (BoE) possesses both the obligation and authority to persist with its ongoing cycle of rate hikes, which has thus far encompassed 11 increases amounting to 425 basis points since February 2022. As per Jalinoos, Sonia futures have already priced in GBP as a prominent G10 high yielder by December, with a terminal rate of around 5.50%. This rate is expected to be achieved by the BoE raising the rate by 25bp at each of the upcoming four meetings.

It is probable that the possibility of the GBP maintaining a significant yield advantage over the EUR in the long term is still being assimilated, despite the fact that the GBP was a frequently traded market short for several months. He further states that this will facilitate further downward momentum for EURGBP towards our designated objective.

According to Credit Suisse strategists, there is an expectation for the Euro-Pound to trade at 0.8550, which would lead to a target exchange rate of 1.17 for the Pound-to-Euro.