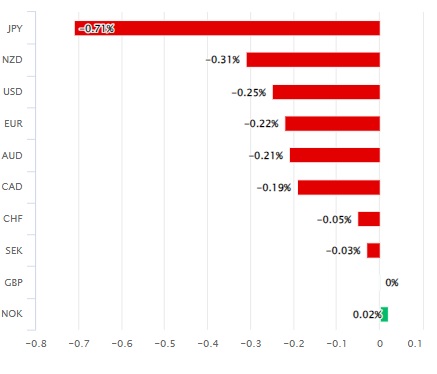

Pound Sterling saw a slight retreat against major currencies, including the Euro and Dollar, in the recent week’s closing session. The decline followed the release of retail sales data for July, which indicated a more significant drop than anticipated. This dip was spread across various product categories and was, in part, attributed to the inclement weather that prevailed during the period.

Pound Sterling saw a slight retreat against major currencies, including the Euro and Dollar, in the recent week’s closing session. The decline followed the release of retail sales data for July, which indicated a more significant drop than anticipated. This dip was spread across various product categories and was, in part, attributed to the inclement weather that prevailed during the period.

The latest figures reveal a contraction of -1.2% in retail sales volume and -1% in sales value during the previous month. Both these metrics fell short of economists’ consensus forecasts for milder contractions. This downturn caused the total volume of sales to regress by approximately -1.8%, slipping below levels seen before the pandemic.

July’s Rainy Conditions Trigger Retail Slump; Online Shopping Surges

While sales measured by value remained 16.4% above pre-pandemic levels due to rising costs in energy, staff, and inputs, the Office for National Statistics uses sales volume as the measure when assessing overall economic growth.

The Office for National Statistics commented on the situation: “Supermarkets reported that some of the fall was because of the poor weather reducing summer clothing sales. However, food sales in supermarkets also fell back.”

The trend toward online shopping gained momentum due to both unfavorable weather conditions and increased promotions, accounting for 27.4% of retail sales in July 2023, up from 26.0% in June 2023 – marking the highest proportion since February 2022.

Despite the prevalence of rain and overcast conditions throughout July, experts contend that the sales decline could have been even steeper if not for online discounts tied to an Amazon Prime event. However, some analysts believe that further sales declines might be contained in the coming months.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, noted, “A reduction in non-store [online] sales in August likely will counter only some of the rebound in store sales. We continue to expect households’ real disposable income to rise briskly and to be about 2.0% higher in Q4 than a year ago.”

A potential boost awaits the economy, households, and retail spending in October with a planned reduction in the Office for Gas and Electricity Markets (OFGEM) price cap. This reduction is set to alleviate downward pressure on incomes for households not bound by fixed-term energy contracts. The cap fell by nearly £500 in July.

Furthermore, a nearly 10% hike in the national minimum wage in April, coupled with wage growth in segments of the private and public sectors, has bolstered average pay packets in recent months. This trend is exemplified in the latest data.

Rui Ding, a Market Strategist at Citi FX, pointed out, “Our economists warn this was primarily the result of a large backward revision to the data for May, as well as the NHS payment bonus.”

Forecasts for further increases in the Bank of England Bank Rate have been reiterated by many analysts and economists in light of Wednesday’s employment data and inflation figures. These figures suggest a considerable moderation last month, albeit slightly less than the economist consensus had indicated.

Despite this moderation, the core inflation rate, a crucial indicator that generally follows the overall rate, remained unchanged at 6.8%. This stability was primarily attributed to increases in housing costs linked to interest rates, along with higher prices for hotels and air transport.

Marc Cogliatti, Head of Global Capital Markets EMEA at Validus Risk Management, highlighted concerns about inflation, particularly as UK average earnings surged. Excluding bonuses, wage growth jumped by 7.8% in the three months leading to June compared to the same period a year ago.

While airfare hikes partly reflect increased fuel costs rather than demand, the uptick in hotel prices has been bolstered by government-sponsored accommodations for asylum-seeking migrants and refugees from France. These accommodations are estimated to cost around £6 million per day in hotel fees.

Notably, the Bank Rate has already risen from 0.1% to 5.25% between December 2021 and August 2023. This increase has placed a significant strain on business and household incomes, especially considering that average household energy bills remain approximately £1,500 higher than those in April 2020, even with the anticipated decline in October.

Julian Jessop, Economics Fellow at the Institute for Economic Affairs, cautioned, “The headline rate of inflation is also likely to tick up in August, reflecting higher fuel and alcohol prices, some unhelpful base effects, and the continued strength of the labor market.”