As we approach 2024, foreign exchange strategists at investment giant Morgan Stanley express a pessimistic outlook for Pound Sterling within the G10 space, anticipating a decline to crisis-era levels against the Dollar. The bank’s forecast presents a sobering projection that envisions challenges ahead for the British currency.

As we approach 2024, foreign exchange strategists at investment giant Morgan Stanley express a pessimistic outlook for Pound Sterling within the G10 space, anticipating a decline to crisis-era levels against the Dollar. The bank’s forecast presents a sobering projection that envisions challenges ahead for the British currency.

Heading Towards Crisis-Era Levels: Morgan Stanley’s Perspective

Morgan Stanley strategists assert their cautious stance on Pound Sterling, characterizing it as the “most negative” outlook within the G10 currencies for the upcoming year. This negativity, they say, materializes in a year-ahead forecast that envisions the Pound depreciating to crisis-era levels against the Dollar.

Factors Contributing to Pound Weakness: Normalization of UK Monetary Policy

Contrary to past instances where dramatic events triggered notable Pound underperformance, Morgan Stanley foresees a more subdued yet impactful decline. The primary drivers identified include sustained Dollar strength coupled with a Bank of England-induced depreciation of Pound Sterling, leading to levels reminiscent of September and October 2022 when global markets reacted to former Prime Minister Liz Truss’s mini-budget.

Normalizing UK Monetary Policy: Interest Rate Cuts Anticipated

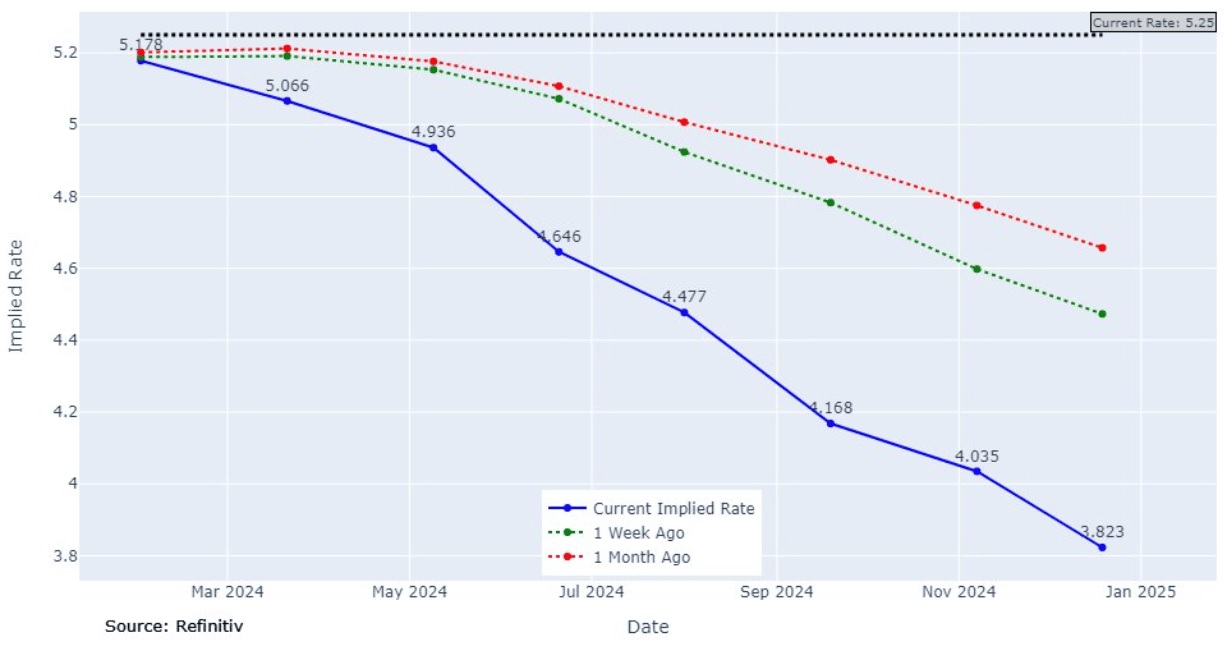

Morgan Stanley’s analysis points toward a significant theme for 2024: the normalization of UK monetary policy. They anticipate interest rate cuts at the Bank of England as disinflation persists and economic growth remains tepid. Forecasts suggest that UK yields will decrease across the term structure in anticipation of these cuts, a trend historically linked to a weaker Pound.

Concerns Over GBP and Interest Rate Expectations: Matthew Hornbach’s Insights

Matthew Hornbach, a strategist at Morgan Stanley, shares insights into the bank’s perspective. He notes that Pound Sterling benefited in 2023 from its “high carry” due to elevated UK bond yields, anticipating higher Bank of England interest rates. However, Hornbach predicts a faster and more aggressive rate-cutting approach by the Bank, leading to a negative impact on the Pound.

USD Strength Expected to Persist: The ‘Stronger for Longer’ Trend

In contrast to the Pound’s forecast, Morgan Stanley anticipates continued strength in the U.S. Dollar, foreseeing further gains in the first half of 2024. The bank’s forecast envisions the Dollar Index (DXY) rising to 111 by spring, reflecting a roughly 5% gain from current levels. This expectation is rooted in U.S. outperformance across various metrics.

Projected Exchange Rates: Pound-Dollar and Euro-Pound Dynamics

Morgan Stanley’s projections suggest a decline in the Pound-Dollar exchange rate to 1.14 by mid-2024 and 1.15 by year-end, levels last witnessed during crises such as the Truss crisis and the Covid pandemic. The Euro-Pound rate is predicted to rise to 0.90 by the end of 2024, resulting in a Pound-Euro conversion of 1.11.

Conclusion: Navigating Challenges in the Currency Markets

As we navigate the complexities of 2024, Morgan Stanley’s analysis underscores the challenges ahead for Pound Sterling. The anticipated normalization of UK monetary policy, coupled with a robust U.S. Dollar, sets the stage for a nuanced yet impactful shift in currency dynamics. While crisis-era levels are predicted, the emphasis remains on a measured rather than dramatic descent for Pound Sterling.