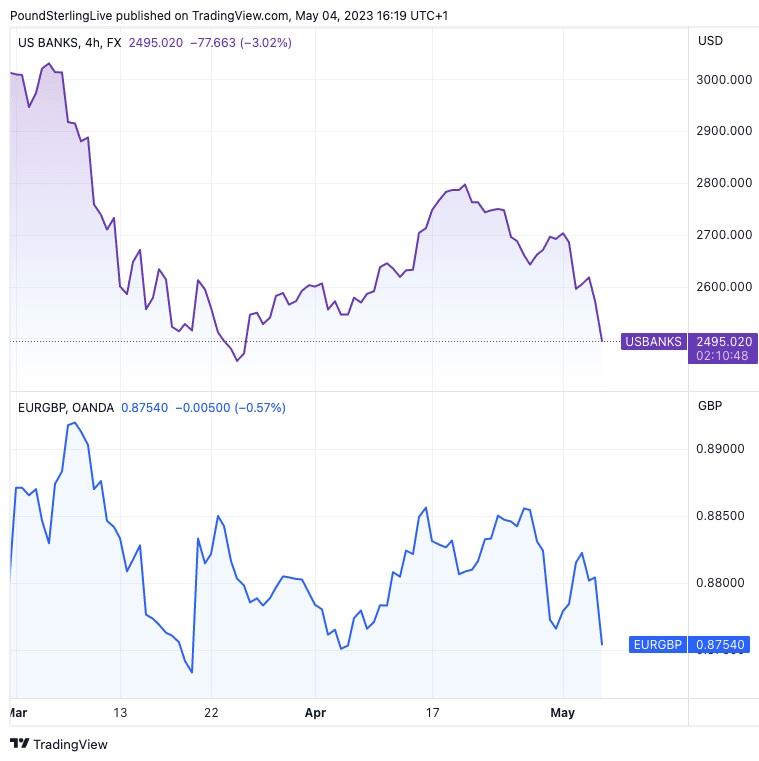

The demand for Pound Sterling is rising as a result of rising worries about the stability of U.S. financial systems and speculation that the European Central Bank may have reached the apex of its interest rate hiking cycle. The repeated tales of upheaval from regional banks sent global markets plunging.

The demand for Pound Sterling is rising as a result of rising worries about the stability of U.S. financial systems and speculation that the European Central Bank may have reached the apex of its interest rate hiking cycle. The repeated tales of upheaval from regional banks sent global markets plunging.

According to IG’s chief market analyst Chris Beauchamp, the specter of the 2008 U.S. bank crisis is once again looming over investors’ minds. Despite Jerome Powell’s recent claim that the U.S. financial system is in good health, it is in danger of destabilizing since numerous institutions are under enormous strain.

Analysts claim that when the banking sectors in the United States and Europe are under stress, the stability and adequate financing of the United Kingdom’s banking industry protects UK assets like stocks and the Pound.

According to Derek Halpenny, MUFG Bank’s Head of Research for Global Markets EMEA, the bigger banking sectors in the United States and Europe may be helping the pound. When compared to the United States and the Eurozone, investors have more trust in the United Kingdom’s banking industry to avoid unpleasant shocks.

Western Alliance is reportedly considering a number of strategic options, including the possible divestiture of its businesses, as reported by the Financial Times. PacWest’s stock plunged by more than 40 percent on Thursday morning after the business said it was examining its strategic alternatives after receiving interest from prospective investors and partners.

Due to an ongoing upward trend, the GBPUSD exchange rate reached a one-year high on Friday at 1.2615. This has been bolstered by expectations of a rate hike from the Bank of England the next week and the widespread perception that the Federal Reserve has completed its rate-hiking cycle. The Federal Reserve may need to decrease interest rates before other central banks if the United States is the heart of the financial crisis.

Due to increased demand, the Euro/Pound exchange rate has risen over 1.1425. The possibility that the European Central Bank (ECB) would stop raising interest rates has added gasoline to the fire. European Central Bank (ECB) interest rates would be raised by another 25 basis points if inflation statistics justified it.

Investors have their largest ‘long’ position on the Euro since late 2020, according to data on market positioning taken just before the ECB announcement. The value of the Euro may fall if the European Central Bank (ECB) made a decision that was surprisingly dovish. The bar has been set extremely high for the ECB, which would need it to dramatically improve its hawkish credentials to sustain the Euro’s present strength.

ING Bank’s Global Head of Macro, Carsten Brzeski, claims that the European Central Bank is nearing the end of its current tightening cycle after raising its policy interest rate by 25 basis points.

He goes on to say that the ECB would move with more care because of the present macroeconomic environment’s exceptional complexity as a result of variables including recent rate rises, financial crisis, slow growth, and stubbornly sticky inflation. With ECB rate rise expectations now at their highest point, the prospect of the top for Euro exchange rates has grown.