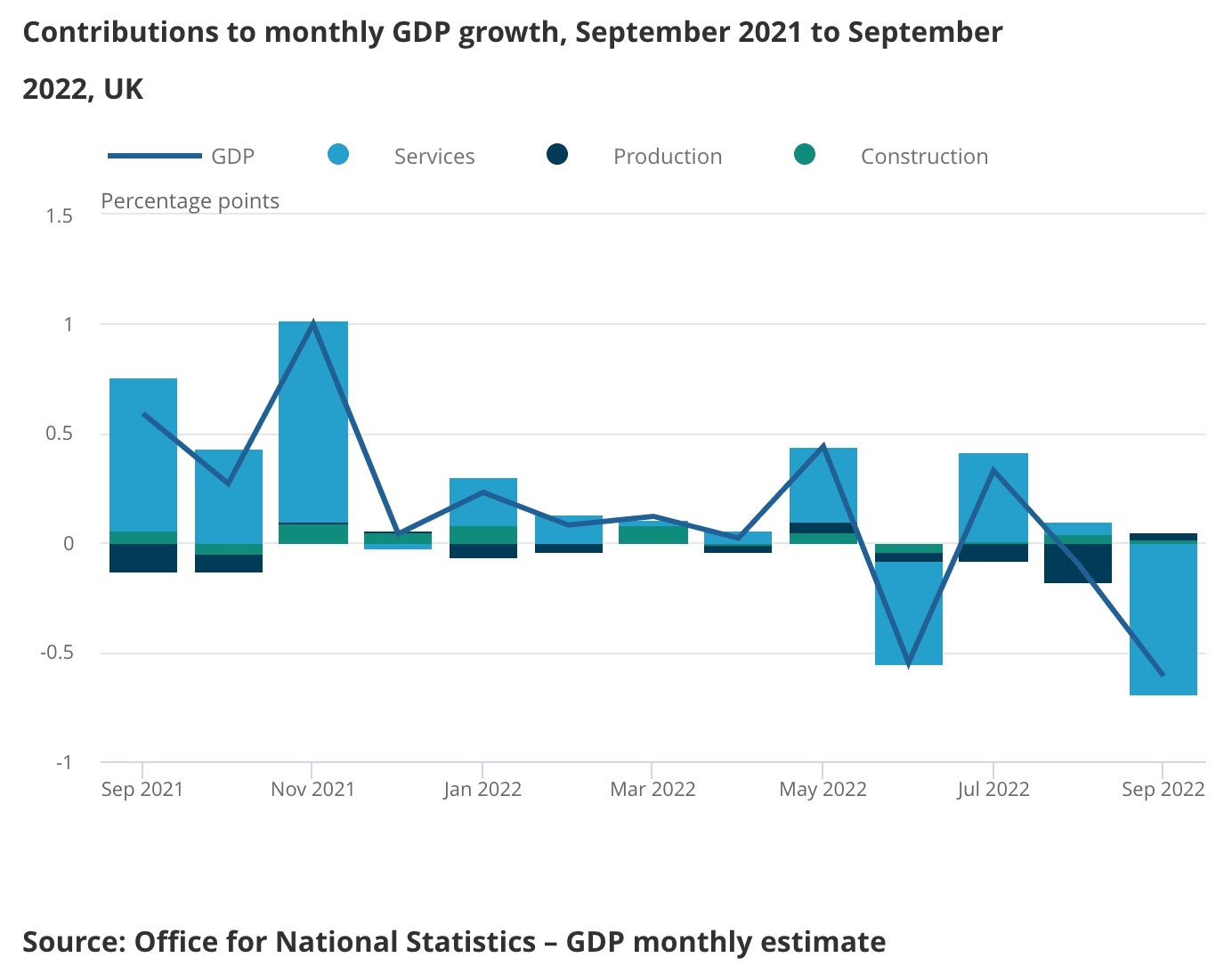

The British Pound maintained its Thursday advances against the US Dollar, the Euro, as well as other top currencies after the announcement on Friday of UK GDP figures indicating a 0.6% contraction in the UK economy in September. The market anticipated a 0.4% decrease, which would generally be disappointing for Sterling.

The British Pound maintained its Thursday advances against the US Dollar, the Euro, as well as other top currencies after the announcement on Friday of UK GDP figures indicating a 0.6% contraction in the UK economy in September. The market anticipated a 0.4% decrease, which would generally be disappointing for Sterling.

Nevertheless, the ONS issued a substantial amount of data for the manufacturing, construction, and commerce sectors, the bulk of which exceeded forecasts. “A UK winter downturn might still be averted, but the poor trend is evident,” says Investec analyst Sandra Horsfield. Our assessment is that the economy may avert sliding into a downturn this winter if production recovers significantly after the October bank holiday.

Upon the revelation of weaker-than-anticipated US inflation figures, the Pound climbed 3.0% versus the Dollar on Thursday, the largest one-day increase ever recorded. As a matter of fact, this was the Dollar’s lowest moment in more than a decade. Consequently, it will take over a 0.2% divergence in the UK’s monthly GDP number to erase this change. The ONS calculated that the additional bank holiday for the Queen’s burial was responsible for “at least 50%” of September’s decline in real GDP.

The moving three-month-on-three-month measurement of UK economic expansion indicated a decrease of 0.2%, which was lower than the -0.5% that the market had anticipated. The year-over-year growth rate for the entire third quarter is 2.4%, above the 2.1% forecast. “Bright spots – UK statistics somewhat stronger than anticipated,” says Michael Hewson, CMC Markets’ chief market analyst.

For a technical downturn to be proclaimed, the fourth and first quarters of 2023 must both have negative values, which might be averted if the rebound after the Queen’s burial is robust. Likewise, manufacturing statistics for September revealed 0% increase, higher than the -0.40% projected by markets, while industrial output climbed 0.2% against projections of a 0.2% decline.

In September, the trade imbalance was £15.6 billion, which is higher than the -£18.7 billion that the market had anticipated. Contrary to forecasts of a -0.6% decline, construction production rose 0.4% in September, confounding predictions of a -0.6% decline. This information suggests that the economy is performing better than anticipated, mitigating the negative effect of the GDP number for September, which has a great lot in common with the Queen’s funeral dragging down economic activity.

After the Bank of England’s October caution of an imminent eight-quarter-long downturn, the outlook for the British economy is particularly bleak; consequently, it will require very terrible data releases to meaningfully alter the dial.

With summary, the Pound has indeed been awash in negative domestic data, and this may now be fully “in the pricing.” The Pound to Euro currency conversion rate is now quoted at 1.1460, maintaining Thursday’s 1.0% increase, while the Pound to Dollar currency exchange rate is 1.1726, up 3.15% yesterday.

Considering the light UK schedule, the bigger international situation has been more influential for the Pound last week, and Friday’s trading in the pound should mirror broader trends. The reaction to U.S. inflation figures indicating that prices had eventually achieved their high and were beginning to decline was quite enthusiastic.

This enabled investors to wager that the completion of the Federal Reserve’s rate-hiking process is near, and they purchased equities, commodities, as well as other ‘risky’ instruments such as the British pound. If markets rise through the end of 2022, the Pound will certainly strengthen more. The domestic picture for the pound currently centers on Chancellor Jeremy Hunt’s Autumn Statement on November 17, when expenditure cutbacks and tax increases are anticipated to be announced.

According to economists, this would undoubtedly present considerable challenges to the UK’s economic development and might have a detrimental effect on the Pound’s popularity. According to Horsfield, “significant budgetary austerity at a period when the pull of increasing benchmark interest rates on capital and consumer expenditure is expected to increase would certainly cause a recession in 2023.”

“The Autumn Statement in the upcoming week might mark a significant shift from lax to restrictive fiscal policy in the United Kingdom. In our judgment, a change to an unduly restrictive policy will exacerbate the downturn that the United Kingdom is expected to experience in 2023 “says Chief UK Economist at Oxford Economics, Andrew Goodwin.

The US Dollar’s slide over the last twenty-four hours has served as a nozzle for the pressure that has been exerted on the British pound over the previous several weeks; nevertheless, this trend will likely approach its limit in the near future. This might enable Forex markets to resume their attention to the UK economy, where the prognosis remains grim for the Pound.