Financial markets applauded the UK’s Autumn Statement, which pledged a restoration of fiscal sustainability, but the British Pound’s near-term path will be determined by global investor mood. As part of his efforts to guarantee that the nation’s finances stayed on a sustainable foundation, Chancellor Jeremy Hunt pledged £55BN in savings, or around 2.0% of GDP.

Financial markets applauded the UK’s Autumn Statement, which pledged a restoration of fiscal sustainability, but the British Pound’s near-term path will be determined by global investor mood. As part of his efforts to guarantee that the nation’s finances stayed on a sustainable foundation, Chancellor Jeremy Hunt pledged £55BN in savings, or around 2.0% of GDP.

According to Paul Dales, Chief UK Economist at Capital Economics, “the progress looks sufficient to please the financial markets.” Following the developments, the bond market expressed its endorsement as UK gilts stayed firmly underpinned. In reality, the yield offered on these notes was lesser than it was on the day of previous Chancellor Kwasi Kwarteng’s mini-budget, indicating that the risk-premium created by that incident has been substantially negated.

“HMT would have desired a neutral response from the financial markets to the Autumn Statement. Task accomplished, “says Simon French, an economist at Panmure Gordon. Michael Field, European Equity Strategist at Morningstar, explains, “A steady FTSE and GBP to EUR and USD exchange rates show implicit agreement from money markets, a need following the futile attempt at a mini-budget by the chancellor’s predecessor barely two months before.”

The Pound-Euro exchange rate is likely to conclude the week marginally higher, while the Pound-Dollar exchange rate is also marginally higher for the week, maintaining the preceding week’s massive gains. Some economists predict that markets will not embrace the imposition of more austerity measures on an economy that is already contracting.

MUFG’s Chief of Research for Global Markets EMEA, Derek Halpenny, anticipates that the British pound will continue to lag other non-USD G10 currencies in the future. “Strengthening fiscal policies during a recession will impact on the pound”

The majority of experts believe that markets would appreciate a restoration to a more serious and pragmatic approach to UK fiscal policy after the Truss-Kwarteng catastrophe. “There were few shocks – a rigorous, ‘everything-but-the-kitchen-sink’ budget had already been factored into the GBP, and bond markets enjoy frugality since it is disinflationary,” states Giles Coghlan, Chief Market Analyst at HYCM.

Understanding the market’s response to the Autumn Statement was hampered by a terrible day for international capital markets, which revealed a climate of low investor sentiment, so producing circumstances that generally disadvantage the “strong beta” Pound. “Sterling retreated from three-month peaks versus the U.S. dollar as international markets declined,” said Joe Manimbo, senior market analyst at Converge.

Latest market activity suggests that the Pound’s short-term trend may rely mostly on world market dynamics than on UK events, especially considering that the Bank of England’s interest rate announcement for December is not expected until December. The unfavorable economic prospects for the United Kingdom, according to some experts, will keep acting as a headwind for the British pound.

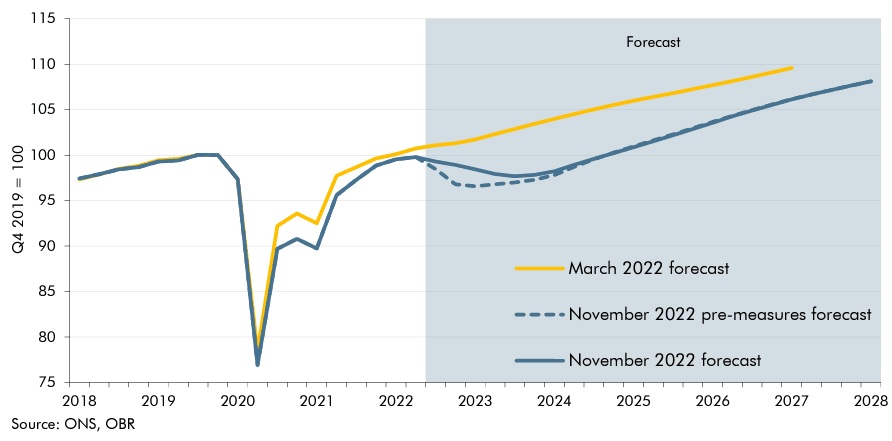

Due to the fact that comparative economic performance is a primary primary factor of currency rates, a more pronounced UK economic downturn compared to other countries creates negative implications for the Pound. Manimbo asserts that Britain’s gloomy underlying environment continues to undermine sterling appreciation. The Office for Budget Responsibility (OBR) indicated in its most recent set of economic estimates that the country was entering a recession that would endure for little more than a year, with a peak-to-trough GDP decline of 2%.

The jobless rate is projected to increase by 505,000, from 3.5% to 4.9% in the third quarter of 2024. Sam Lynton-Brown, chief head of macro strategy at BNP Paribas, asserts, “Tight fiscal and monetary policies imply a lower pound.” The stricter fiscal policy resulting from the £55 billion in savings outlined by the Chancellor mixes with the Bank of England’s restrictive monetary guideline, which keeps raising interest rates, so pinching the economy.

The weakening GDP picture, according to Lynton-Brown, is “bearish for GBP… we prepare for more GBP weakness through a 0.9050 – 0.9300 EURGBP call spread on January 13.” Nevertheless, the OBR’s macroeconomic estimates are far more positive than those provided by the Bank of England. This is significant for the Pound, which plummeted after the Bank of England’s October Monetary Policy Report forecasted an eight-quarter downturn.

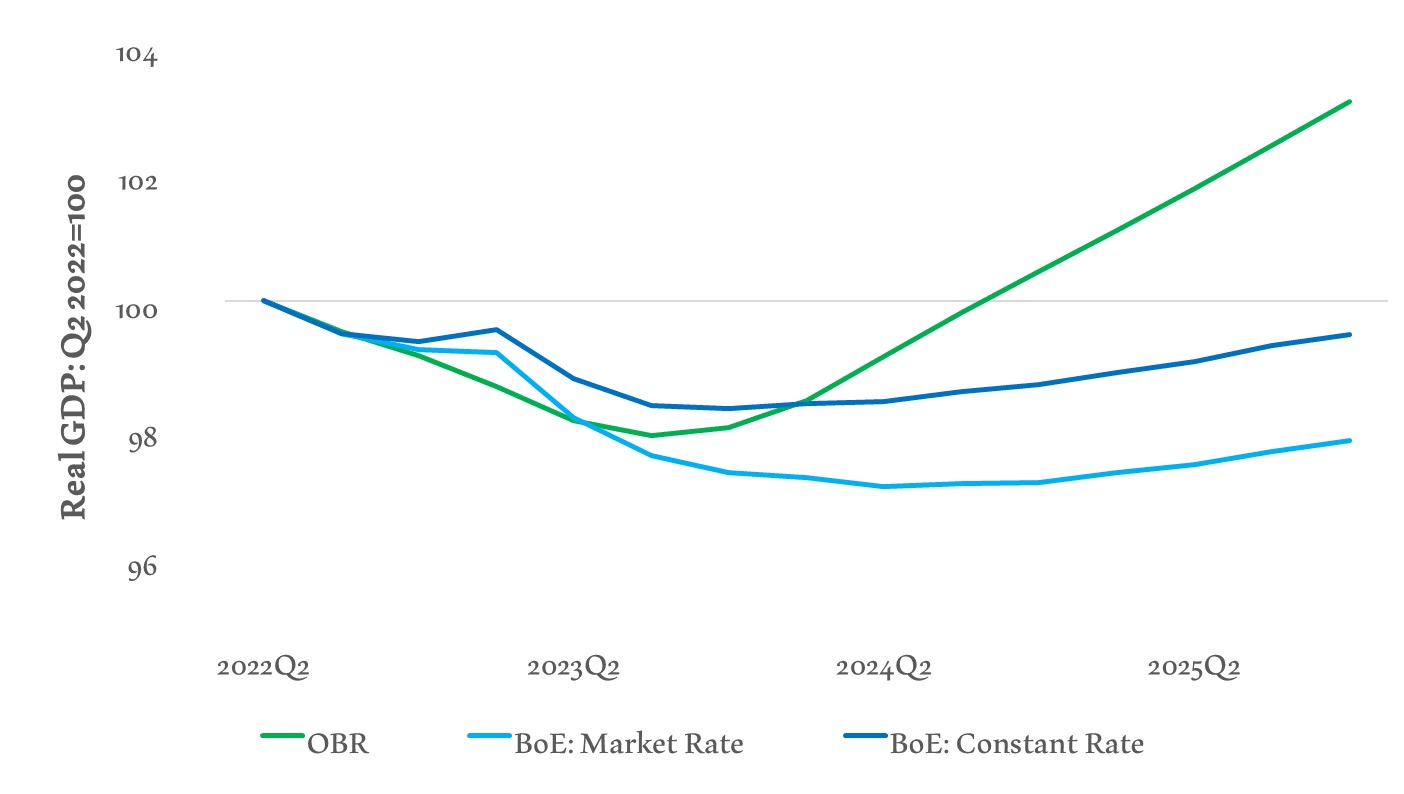

The graph below depicts the recent forecast from the Office for Budget Responsibility (OBR) and two projected timeframe situations from the Bank: one utilizing current bank rate settings (dark blue) and then one predicated on where the economy would be if bank rates were to increase to 5.25 percent, in accordance with market forecasts.

In both cases, the Bank of England seems to be more gloomy than the OBR, whose projection provides Forex markets a pleasant positive surprise. In light of the fact that upsets may affect a currency’s value, the OBR’s positive surprise might result in more backing for the pound in the following weeks.

Hunt and Prime Minister Rishi Sunak aimed to reestablish economic confidence with the Autumn Statement, and the response of the market shows they were successful. As a result, the balance of the year might see Sterling’s emphasis shift from local to foreign factors, thus the evolution of international markets could be the narrative to follow. In light of the turbulence of the last year, this is something the administration would appreciate.