The pound-to-dollar exchange rate fell by 0.0013 percent, or 0.09 percent, to 1.3495 on Friday, November 5, from 1.3507 in the previous trading session. During its November meeting, the Bank of England voted by a 7-2 margin to maintain its benchmark interest rate at a record low of 0.1 percent, and by a 6-3 margin to maintain its bond-buying programme in its current form.

The pound-to-dollar exchange rate fell by 0.0013 percent, or 0.09 percent, to 1.3495 on Friday, November 5, from 1.3507 in the previous trading session. During its November meeting, the Bank of England voted by a 7-2 margin to maintain its benchmark interest rate at a record low of 0.1 percent, and by a 6-3 margin to maintain its bond-buying programme in its current form.

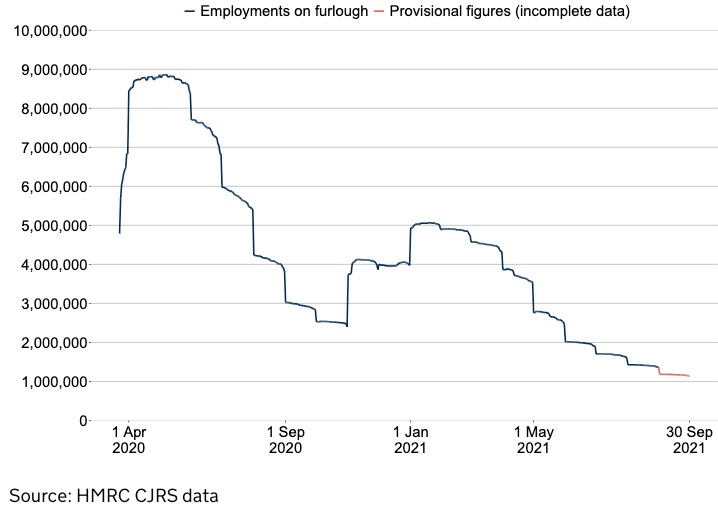

Policymakers were weighing concerns about rising prices against the downside risks of slowing global growth and a potential increase in UK unemployment following the end of furlough schemes in September.

In addition, the central bank said that it will most likely be required to raise interest rates in the coming months in order to bring inflation back to the 2 percent target level. According to current expectations, CPI inflation would peak at roughly 5 percent in April 2022, before declining significantly in the second half of next year as supply disruptions subside, global demand rebalances, and energy prices stabilise.

At the same time, the unemployment rate in the United Kingdom is expected to rise slightly in Q4 2021, while the country’s GDP is expected to return to pre-pandemic levels in Q1 2022. As a result of the policy pronouncement, the 10-year bond yield in the United Kingdom was 0.94 percent on Friday, November 5, according to over-the-counter interbank rate quotations for this government bond term issued by financial institutions.

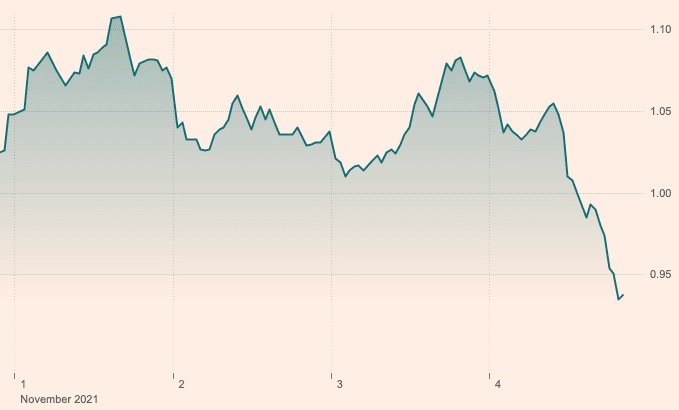

Because to the Bank of England’s November policy update, markets are lowering their expectations for future interest rate levels in the United Kingdom, causing the pound to fall in value. The decision to leave interest rates steady caught the markets by surprise, as they had already pushed expectations for a November rate hike to a near-certainty by late October, positioning that boosted the value of the pound in the process.

This 100 percent confidence was compatible with the Pound-Euro exchange rate reaching a 2021 high of 1.19 on October 26; however, this assurance progressively eroded, and the Pound fell along with it as well. Expectations for a rate rise were still high by the time the Bank of England made its decision on Thursday, with a December hike considered as a foregone conclusion in the event that the Bank chose not to raise interest rates this year. However, the Bank of England essentially yanked the rug out from under the market by implying that a December rate rise may also be off the agenda.

Josh Mahony, Senior Market Analyst at IG, explains that the pound has been struck particularly hard since markets were pricing in a 62 percent possibility of an interest rate increase today. “This has resulted in a significant move down for the pound,” adds Mahony. The near-1.0 percent loss in the Pound to Euro exchange rate on Thursday is the worst one-day decline in the pair since September 28 and has a significant negative impact on the pair’s technical outlook. Back in September, though, the pound quickly regained its footing and began a strong rally. Will the downturn that began on Thursday eventually diminish over the next several days, paving the way for a rally comparable to the one that began in September?

Much will depend on how bond markets respond in the coming days and weeks, as well as on whether or not investors can regain trust in the Bank of England’s forward guidance; after all, confidence will have been shattered by this unexpected turn of events. Because of the decline in expectations for interest rate hikes, investors flocked to UK bonds, causing their yields to plummet, with the ten-year UK government bond yielding below one percent once more:

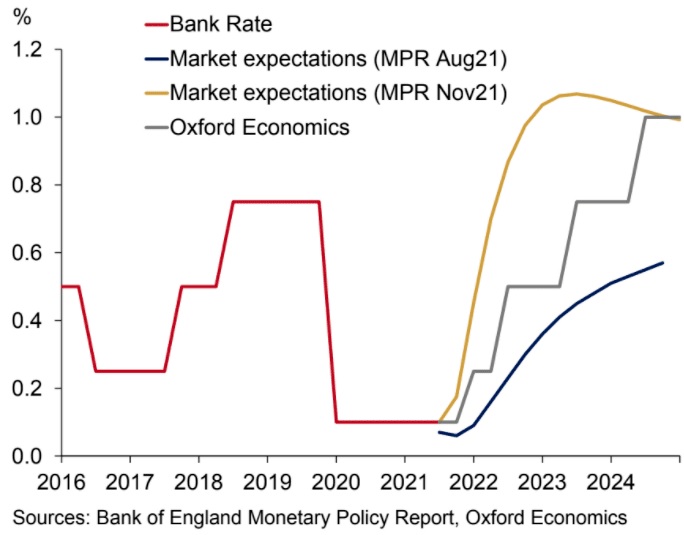

Declining yields reduce worldwide investor interest for UK bonds, so depriving the pound of a source of demand that would otherwise be available. Prior to the November meeting, the market not only anticipated a rate rise in 2021, but it also anticipated significant increases in 2022, with the Bank Rate projected to reach as high as 1.10 percent by June 2022, according to money market pricing.

However, the Bank of England has now made it apparent that such a tightening of monetary conditions was not required, putting a damper on these high expectations in the process. Economists continue to believe that a rate rise in December or February is still a possibility, and that this might eventually prevent further losses in the pound.

Oxford Economics’ Andrew Goodwin says the MPC’s decision to raise interest rates was a clear signal that the pace of tightening would be much more gradual than markets had anticipated. “The MPC made clear that a rate hike was coming soon, though it also sent a clear message that the pace of tightening would be much more gradual than markets had anticipated,” Goodwin says.

“Whether the Bank of England raises interest rates in December or February is a carefully balanced question,” says Goodwin.

Oxford Economics prefers February as the start date for the furlough plan since there will be little clear information on the effect of the termination of the scheme by the December meeting, according to the firm. In addition, they anticipate one more rate rise next year, which would bring the Bank Rate down to 0.5 percent by the end of 2022.

The Bank said that the decision to postpone hiking rates was based on a wish to assess the effect of the government’s work assistance plan (furlough) coming to an end at the end of September. As a result, whether or not liftoff occurs in December might be determined by the job report for November, which will cover the period from October to November.

According to HMRC figures given ahead of the Bank of England’s decision on Thursday, by the end of the scheme’s deadline on September 30, 410K firms were being offered assistance, with a total of 1.14 million jobs being placed on furlough. This is a drop of 210K over the previous month, when there were still 1.35 million employees on furlough at the end of August. Meanwhile, according to a poll conducted by Lloyds Bank, 60 percent of firms with furloughed employees would welcome back all of their furloughed employees.

According to the Office for National Statistics’ fortnightly business survey, by late October, 87 percent of furloughed employees had returned to work, 3 percent had been made permanently unemployed by the government, 3 percent had voluntarily left their position, and 8 percent had been classified as “other.”

The Labor Department’s report on the labour market on November 16 is expected to reveal statistics consistent with a labour market that is strong enough to withstand a modest interest rate increase from its crisis-era low point. Therefore, a positive employment data might revive support for the pound, but for the time being, sellers seem to be in control of the currency market.

Irrefutably, the IHS Markit/CIPS UK Construction PMI increased to 54.6 in October 2021 from 52.6 the previous month, well above the market consensus of 52.0. After a period of stagnation, the latest data indicated an increase in business activity growth throughout the construction industry, albeit it was still much lower than the 24-year peak reached in June amid concerns of severe supply restrictions and quickly rising purchase costs.