After the Reserve Bank of New Zealand startled the market with a ‘hawkish’ monetary policy statement, the New Zealand Dollar surged back into action on Wednesday, pushing GBP/NZD into a nosedive as it led the table of top currencies into the mid-week trading session.

After the Reserve Bank of New Zealand startled the market with a ‘hawkish’ monetary policy statement, the New Zealand Dollar surged back into action on Wednesday, pushing GBP/NZD into a nosedive as it led the table of top currencies into the mid-week trading session.

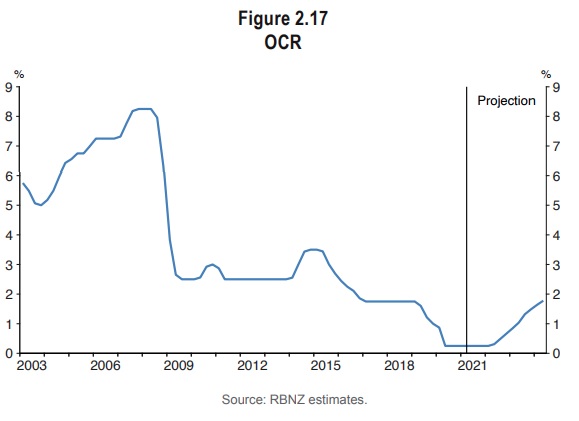

The New Zealand’s central bank surprised both the market and the Kiwi Dollar when it really confirmed investors’ latest anticipation for an cash rate hike as early as the middle of 2021, but also rewarded the market’s optimistic camp with higher-than-expected benchmark interest rate predictions for the following years.

This forecast is contingent in the sense that it indicates the policy course necessary to achieve the economic goals in wake of the financial outlook and the projected effects of many other monetary policy instruments. “Shifts in the OCR forecast should mirror future changes in the economic forecast,” the Reserve Bank of New Zealand (RBNZ) stated in its quarterly update.

The RBNZ stated in its most recent quarterly predictions that the benchmark interest rate may revert to 1.75% by mid-2024, significantly earlier than the currency market had expected, while also repeating that the NZ$100 billion allocated to the bank’s first quantitative easing program is an upper “bound,” not really a goal.

The latter happened at the same time that the bank stated that it does not anticipate to hit the maximum limit before June 2022, when it would most likely halt the plan, which is good news for New Zealand government bond rates and the Kiwi Dollar.

The OCR track confirms our expectation that the RBNZ will begin to raise rates in August next year, although the uncertainties are now weighted toward an earlier date. “We’ll be paying great attention to statistics on inflationary pressures,” says Sharon Zollner, ANZ’s chief economist.

In reaction to the news, the NZD/USD rate rose over 0.73 for perhaps the first time since March, when the Pound-to-New Zealand Dollar rate plummeted. The RBNZ’s statement came after New Zealand nearly eradicated the coronavirus last year, ahead of several other countries, laying the groundwork for an economic revival that’s already begun a week before, when the Treasury said in its recent budget that the govt will actively support the rebound with additional funding in critical areas over the months ahead.

“The NZD was once again not addressed, which is unexpected given how close it has been to their projections,” says Imre Speizer, chief of NZ strategy at Westpac, who predicts a 0.76 NZD/USD level by year’s end. “We remain optimistic on the NZD/USD and await a break over 0.7300 to establish the bullish trend has returned,” Speizer had previously stated.

The New Zealand Dollar has rebounded in previous weeks from late March lows triggered by GDP statistics that fell short of forecasts and the govt’s unexpected announcement of steps to rein on rising house prices, which dealt a fatal blow to the Kiwi at the moment.

The forecast for the world economy is improving gradually, despite the fact that portions of Asia are presently suffering third waves of coronavirus outbreaks, with key European economies taking measures to reopen this week after the U.S. economic growth gained steam at the start of 2021. “NZD might jump upward and drive AUD/NZD below 1.07 if market players see the projection increases as a hawkish move. According to Carol Kong, an analyst at Commonwealth Bank of Australia, “ASB anticipates the RBNZ to hike the benchmark interest rate in August 2022.”

Nevertheless, the Renminbi’s up to this point successful effort this week to break through a persistent 2021 resistance level versus the Dollar is a bearish event for the US currency, which is inversely connected with the commodity-sensitive Kiwi and is also favorable of a wide range of certain other currencies.

Overall, this week’s events in New Zealand and abroad are negative for the Pound-to-New Zealand Dollar rate, which generally corresponds strongly with the receding US Dollar and had previously been on a long rip upward, momentarily breaking over the 1.97 level.

According to Mazen Issa, an analyst at TD Securities, “the fall below 6.40 in USDCNH might contribute to USD pressure, benefiting EUR, GBP, CHF, and the antipodes. We include NZDUSD long to our TOTW in combination with a favorable perspective on risk and correlations to gear.” Issa adds.