The Japanese yen has continued its downward trajectory, marked by a series of losses that have persisted since around midnight yesterday. This trend has seen the US dollar strengthen against the Japanese yen (USD/JPY), reaching a new yearly high at 148.458, a level not seen since November of the previous year. The surge in the dollar’s value followed the announcement of the Bank of Japan’s monetary policy decision.

The Japanese yen has continued its downward trajectory, marked by a series of losses that have persisted since around midnight yesterday. This trend has seen the US dollar strengthen against the Japanese yen (USD/JPY), reaching a new yearly high at 148.458, a level not seen since November of the previous year. The surge in the dollar’s value followed the announcement of the Bank of Japan’s monetary policy decision.

Bank of Japan’s Monetary Policy Decision

The Bank of Japan adhered to expectations by maintaining its ultra-loose monetary policy and keeping the limits of ten-year bond yields within the previously established range. This decision was upheld despite a return to annual inflation growth, with the National Core Consumer Price Index (CPI) recording a 3.1% increase in August on an annual basis, surpassing the anticipated 3.0%.

Cautious Approach to Monetary Policy

Economic analysts are observing a continued influx of unfavorable economic data, which is likely to keep the Bank of Japan cautious about transitioning to a tighter monetary policy, despite the presence of elevated inflation. Factors contributing to this caution include a contraction in manufacturing activities, with the au Jibun Bank Japan manufacturing PMI plummeting to 48.6, its lowest level since the previous February, well below expectations set at 49.9. Furthermore, GDP growth in the second quarter fell short of expectations, accompanied by a more pronounced decline than anticipated in capital spending, industrial production, and household spending. The rise in unemployment rates to 2.7% and a larger-than-expected trade balance deficit in August further underscore the economic challenges.

Japanese Authorities’ Response to Yen Decline

Regarding the ongoing depreciation of the Japanese yen against major currencies, Japanese authorities appear hesitant to intervene in the foreign exchange market to curb national currency fluctuations. The Minister of Finance has expressed reluctance to intervene in support of the yen due to concerns about the extreme volatility such action may trigger. Such volatility could potentially harm the economy and hinder foreign trade, as evidenced by the escalating trade balance deficit, which reached 930 billion in August, the highest level since May.

Bond Market Dynamics

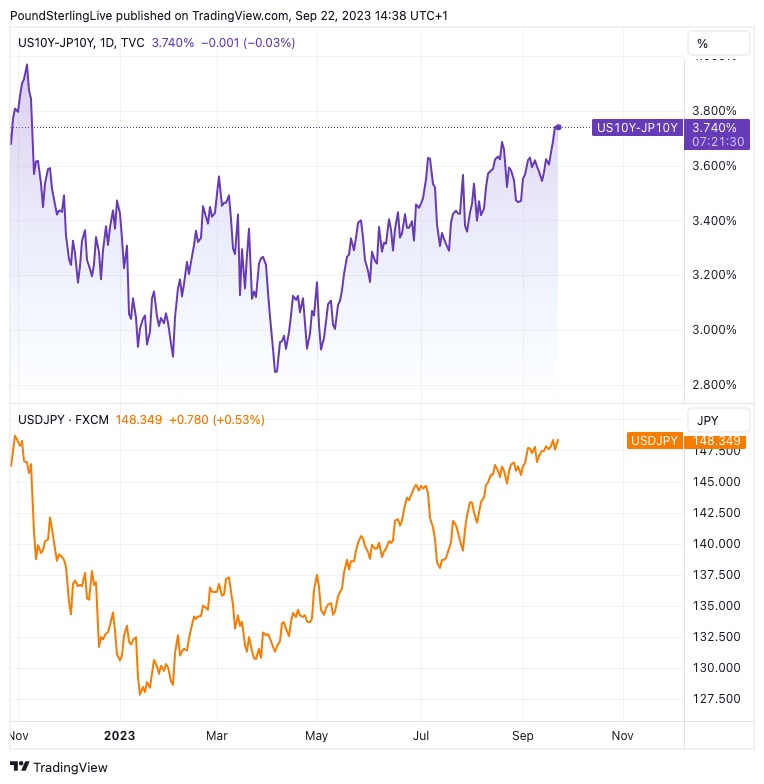

In the bond markets, record-high levels of 10-year Japanese bond yields were observed, peaking at 0.771% during yesterday’s gains. However, these increases failed to provide substantial support for the Japanese yen. The rise in ten-year US Treasury bond yields, reaching levels not seen since 2007, with a peak of 4.509% during today’s Asian session, further widened the gap between US and Japanese yields. This widening spread, now at 3.751%, is the highest seen this year, reminiscent of levels last observed in November of the previous year. This development has exerted additional pressure on the Japanese yen.

Impact on Japanese Bond Markets

These recent developments have taken a toll on Japanese bond markets, with the iShares Core Japan Government Bond ETF (2561), which tracks Japanese government bond performance, reaching its lowest levels since January.

Conclusion

The Japanese yen’s continued decline is shaped by a confluence of economic challenges, including inflation, manufacturing contraction, and unfavorable GDP growth. The Bank of Japan’s cautious approach to monetary policy in the face of these challenges has played a role in the yen’s depreciation. Additionally, the reluctance of Japanese authorities to intervene in currency markets and the widening yield gap between US and Japanese bonds have further compounded the yen’s decline. These dynamics underscore the complex economic landscape in Japan, with ramifications for both domestic and international markets.