The British pound rallied against the green back to trade at 1.3110 levels due to betterment in risk appetite and positivity encircling the continuing Brexit discussions after the UK’s chief negotiator David Frost stated that a deal with the EU is likely in September. Nevertheless, the GBP/USD exchange rallied and encouraged bulls to enter the uptrend again.

The British pound rallied against the green back to trade at 1.3110 levels due to betterment in risk appetite and positivity encircling the continuing Brexit discussions after the UK’s chief negotiator David Frost stated that a deal with the EU is likely in September. Nevertheless, the GBP/USD exchange rallied and encouraged bulls to enter the uptrend again.

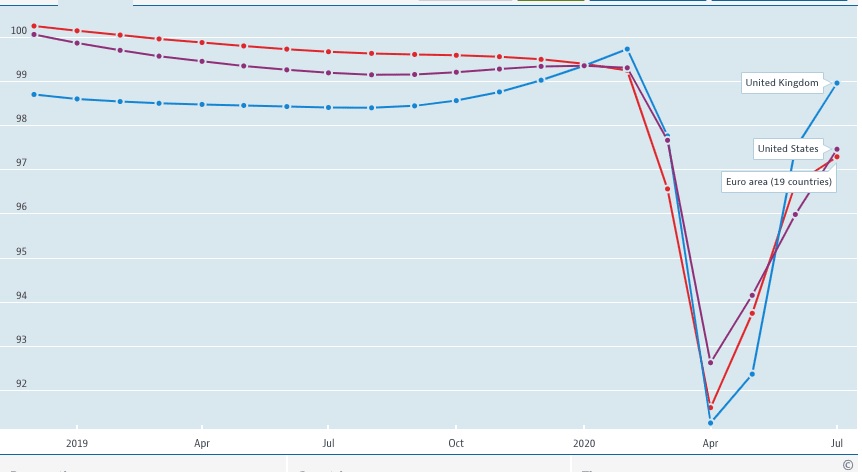

There seems to be three main reasons for the pound to gain strength against the greenback. Firstly, it is the bettering sentiment on Brexit trade discussion. Secondly, global markets remain helpful. Finally, data provided by OECD (Organisation for Economic Co-operation and Development) indicates that the UK economic recovery is better than that of the Eurozone and the US.

With respect to Brexit trade discussions, currently both the EU and the UK have stated that they remain poles apart in several critical issues. Analysts believe that there are little prospects of striking a deal before October. The UK negotiators, however, stated that they are doing everything possible to conclude a deal by September.

On Thursday, the UK chief negotiator David Frost opined that a Brexit agreement is attainable with the EU in September.

“As we keep saying, we are not looking for a special or unique agreement. We want a deal with, at its core, an FTA like those the EU has agreed with other friendly countries, like Canada. The UK’s sovereignty, over our laws, our courts, or our fishing waters, is of course not up for discussion and we will not accept anything which compromises it – just as we aren’t looking for anything which threatens the integrity of the EU’s single market.”

Even though the UK is optimistic of arriving at an agreement, it should be pointed out that it is eventually the EU that establishes the time frame. In October, EU leaders are scheduled to meet during an EU Council summit to make appropriate decisions regarding the Brexit deal.

The pound sterling’s uptrend is also backed by the rally in equity and commodity markets, a notable change as the pound has demonstrated itself to be a ‘risk on’ currency, which strengthens when market view turns bullish. Until the market remains bullish, the pound will remain supported.

On the contrary, when market goes down, generally, the US dollar strengthens. It should be remembered that August is generally a month when markets decline and the greenback tends to strengthen. The heightened tensions between the US and China, and the failure of Democrats and Republicans to agree on a Covid-19 stimulus package may trigger an equity and commodity market selloff.

Finally, the UK economy is making a recovery after entering into its worst recession in the first half of his year. As the restrictions are being eased at the moment, the economy has started gathering pace. Notably, services account for 80% of the UK’s economy.

Therefore, reopening of restaurants, pubs, hotels and other businesses related to service sector would enable the country to return back to growth by the second half of this year.

Currency exchange rates are dependent on economic growth of one country compared with other.

The OECD obtains on-time economic info from largest economies of the world and collates it into Composite Leading Indicator, which provides a glimpse of critical inflection points in an economic cycle and permits us to visualize how economies are operating in comparison to each other.

The graph clearly indicates that the UK economy has rebounded sharply and even eclipsed the performance of the US and the Eurozone. Traders and analysts anticipate the trend to gain momentum in the weeks and months ahead, leading to further strengthening of the pound.

Economists anticipate the unemployment rate to increase by the end of October as the furlough scheme draws to a close, slowing down the recovery. Notably, during that period, the EU and the UK will also be having intense negotiations on Brexit, implying that the pound would see heightened volatility in autumn.