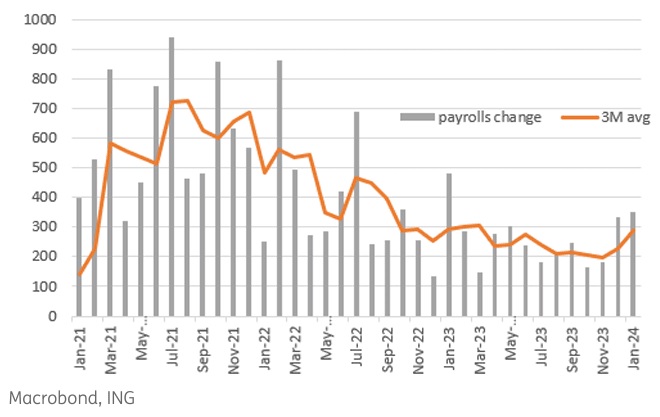

The Pound Sterling faced a substantial downturn against the resilient US Dollar after the release of robust employment and wage data, dashing hopes of an imminent Federal Reserve rate cut in March. The US announced an astonishing creation of 353,000 jobs in January, far surpassing the market’s anticipation of 180,000.

The Pound Sterling faced a substantial downturn against the resilient US Dollar after the release of robust employment and wage data, dashing hopes of an imminent Federal Reserve rate cut in March. The US announced an astonishing creation of 353,000 jobs in January, far surpassing the market’s anticipation of 180,000.

Unprecedented Job Growth Surpasses Market Expectations

The US labor market’s vigor was further underscored by a revision of the previous month’s job creation figure to 333,000. Notably, average hourly earnings surged by 4.5% year-on-year in January, exceeding the revised 4.4% and surpassing the consensus forecast of a retraction to 4.1%.

Chief International Economist at ING, James Knightley, remarked, “The crazy strong jobs number means the Fed will wait,” emphasizing the impact of the unexpected surge in employment figures on Federal Reserve policy considerations.

Market Expectations Rethought Amid Stellar Economic Indicators

These impressive figures have upended market expectations, which were previously pricing in a Federal Reserve rate cut as early as March. The current data suggests that any rate cut may now be deferred until mid-year, questioning the necessity of a cut altogether in light of such robust economic performance.

Matthew Ryan, Head of Market Strategy at Ebury, asserted, “We think that today’s payrolls report has all but completely eliminated any lingering possibility of a March interest rate cut from the Federal Reserve,” emphasizing the decisive impact of the employment data on reshaping market sentiment.

Healthy Economy Defies Predictions of Labor Market Softening

Contrary to market predictions, the unemployment rate in the US remained steadfast at 3.7%, defying expectations of a slight uptick to 3.8% in response to perceived loosening labor market conditions. This resilience suggests a healthy and robust economy that may not warrant immediate intervention through interest rate cuts.

USD Strengthens Across the Board

The strength of the US Dollar was evident across various currency pairs, with the Pound to Dollar exchange rate experiencing a 0.67% decrease to 1.2664, and the Euro to Dollar exchange rate declining by 0.68% to 1.0798. The surge in US bond yields further signaled a reevaluation of market expectations regarding the timing of Federal Reserve rate adjustments.

Experts Forecast Delayed Easing and Dollar Upside

Matthew Ryan of Ebury projected, “This delayed start to easing should be bullish for the dollar, and we continue to see upside potential in the US currency in the near-term,” highlighting the positive outlook for the US Dollar in the wake of delayed expectations for interest rate cuts.

Contrasting Views on Labor Market Trends

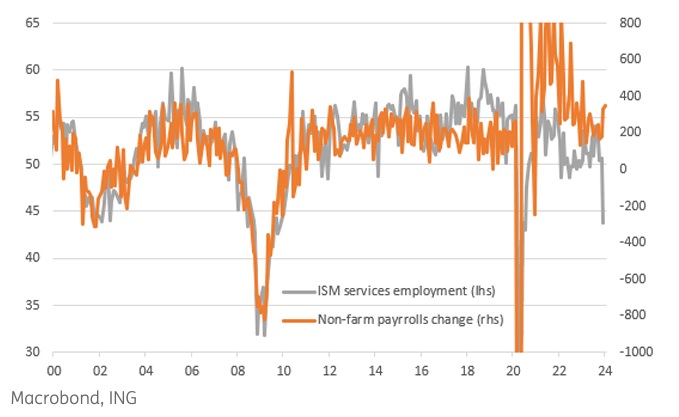

While the non-farm payroll report suggests robust job growth, some analysts, including those at ING Bank, highlight discrepancies with other data prints indicating a cooling job market. Knightley commented, “Labour market surveys are far, far weaker, with both the ISM manufacturing and services sector surveys in contraction territory – indicating job shedding.”

Future Focus on ISM Services Employment Index

Economists are closely monitoring the ISM services employment index, set for an update on Monday. Knightley expressed concern, stating, “It collapsed in January, and if it doesn’t dramatically rebound, then we would be worried that payrolls could soon start to roll over,” underscoring the importance of upcoming data releases in shaping the outlook for the US labor market.

ING Maintains May Rate Cut Prediction

Despite the positive employment data, ING Bank maintains its view that the Federal Reserve will proceed with rate cuts in May, pointing to other indicators suggesting potential challenges in the labor market down the line.