In the following months, experts at the world’s top foreign currency main dealer predict that the British Pound will decline near the lows of 2022. Citibank’s most recent currency study indicates the Dollar is expected to return to its previous highs and the Pound is trading at unsustainable levels due to concerns that the UK economy would lag behind the Eurozone and U.S. economies in 2023.

In the following months, experts at the world’s top foreign currency main dealer predict that the British Pound will decline near the lows of 2022. Citibank’s most recent currency study indicates the Dollar is expected to return to its previous highs and the Pound is trading at unsustainable levels due to concerns that the UK economy would lag behind the Eurozone and U.S. economies in 2023.

Ross Hammond, FX Counsellor at Citi’s Wealth Management division, believes that while the tide will shift against the Dollar, it is likely to be preceded by the last high. “Citi chooses to communicate this through higher Beta FX currencies, especially those more susceptible to housing sensitivity and interest rates risks, such as GBP and CAD,” Hammond explains.

In his current post as head of European FX strategy at Citi, Vasileios Gkionakis oversees research on the pound, and his opinions will eventually influence the advice provided by dealers such as Hammond. Since the Brexit referendum in 2015, Gkionakis has been continuously pessimistic about the pound and continues to cite Brexit as a reason to anticipate permanent underperformance.

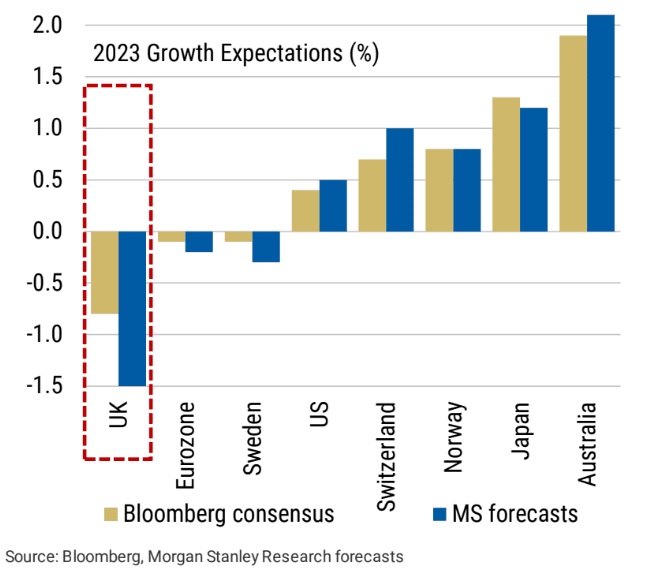

The FX research team at Citi sees the British economy as “burdened by structural weakness due to Brexit.” According to them, ongoing inflation fears would also contribute to pessimism. Citi predicts a more severe and prolonged recession in the United Kingdom than in other major countries, noting the economy’s vulnerability to property market risks.

According to the consensus, the property sector is also a possible source of weakness for the British pound. “We also observe that in times of housing market volatility, the United Kingdom tends to face outflows in stocks and bonds, a situation that is not always favourable for the pound given the assumption that the current account deficit would continue to widen,” adds Hammond.

From October to November of this year, property prices in the United Kingdom decreased by 2.3%, the worst monthly decline since October 2008, according to the bank and mortgage provider Halifax. Citi asserts that property prices affect the value of the pound, and academics reference the 2008-2009 period as evidence, given that both house prices and the pound fell in tandem.

In 2008-2009, a global financial crisis decimated the system’s finances, resulting in a housing market decline. However, the roots of the present housing slowdown are notably different. Significant capital outflows from the UK’s finance-heavy economy in 2008 prompted a decline in the Pound’s value.

The falling home prices of 2022 are caused by increasing interest rates (which can in fact be supportive of Sterling). Nonetheless, “when we approach the new year, markets anticipate the GBP to reverse some of its recent optimism, with a short-term aim of 1.10 versus the USD,” according to Hammond.

Meanwhile, Citi’s FX analysts mention China as a cause to anticipate a decline in the value of the Pound relative to the Euro. “Looking further into the new year, the evolution of the Zero Covid Policy in China is a big driver for major currencies,” says Hammond.

“From a geographical and economic perspective, a depreciation of the British pound would undoubtedly favour the Euro,” he continues. Nonetheless, this idea is again disputed. Pound Sterling This week, Live reported the opinion of Danske Bank that the Pound would appreciate against the Euro in 2023 due to the industrial downturn in the Eurozone, which will impact the “industry-heavy” single currency.

Citi predicts that the Pound to the Dollar exchange rate will revert to 1.10 during the next one to three months, then rebound to 1.26 over the next six to twelve months. On a one- to the three-month horizon, the pound-to-euro exchange rate is projected to decline to 1.14 and to 1.0980 on a six- to 12-month horizon. If you are wanting to safeguard or increase your foreign payment budget, you may want to consider locking in today’s exchange rate for future usage or placing an order for your desired rate when it is attained. You can find more information here. This makes Citi one of the most negative institutions on the British Pound over the next year.