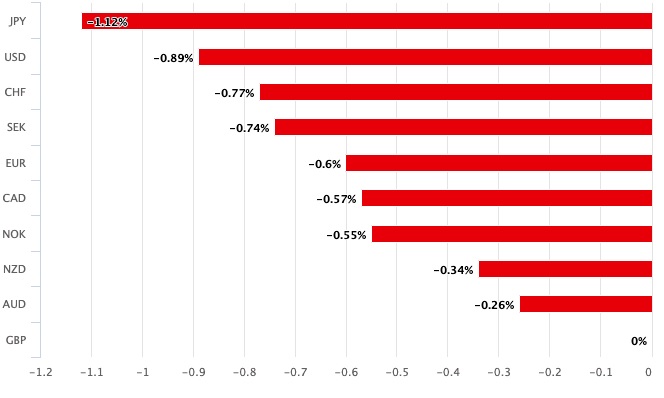

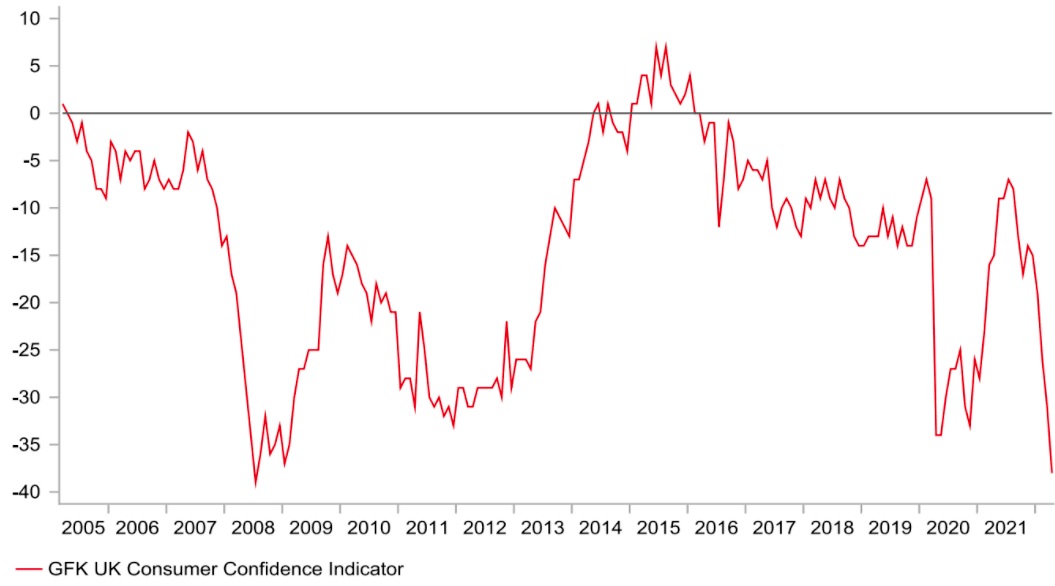

The British Pound has fallen dramatically versus the Euro and the US Dollar after a series of dismal economic data readings. It is possible that economic growth in the UK may drop significantly since consumer confidence in the country has fallen to levels previously witnessed during the Great Financial Crisis of 2008.

The British Pound has fallen dramatically versus the Euro and the US Dollar after a series of dismal economic data readings. It is possible that economic growth in the UK may drop significantly since consumer confidence in the country has fallen to levels previously witnessed during the Great Financial Crisis of 2008.

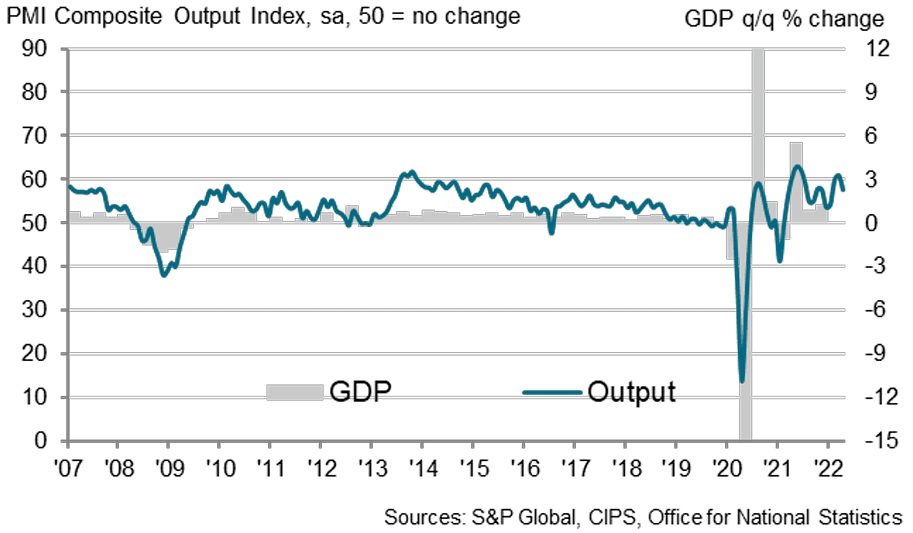

Moreover, retail sales for April were well below forecasts, with a month-on-month decrease of -1.4 percent, much below the predicted -0.3 percent and February’s -0.5 percent. PMI data from S&P Global, which is the most recent of surveys, revealed a further drop in growth rates in April as inflation continues to rise. Derek Halpenny, Head of Research, Global Markets, at MUFG, writes that “It is becoming more likely that GBP sentiment will deteriorate in the next days and weeks as a result of several unfavorable occurrences.”

Pound to Euro exchange rate went below 1.20 again to 1.1947, while the Pound to Dollar exchange rate plummeted by over a percent to 1.2898 on Friday as a result of the bad data. Dominic Bunning, Head of European FX Research at HSBC, opined “We think that the Bank of England will not be able to maintain up with the rapid tightening cycle that the rates market has priced in.”

He further stated “While today’s retail and PMI data bolsters our skepticism, increased political uncertainty at home and abroad will do nothing to ease the plight of the British pound.”

The S&P Global/CIPS Services PMI Flash for April came in at 58.3, much below the market’s expectations of 60 and significantly lower than March’s 62.6. Despite market predictions, the manufacturing PMI came in at 55.3, which was higher than the market had predicted. However, the overall Composite PMI was 57.6, which is lower than the 59 predicted and the 60.9 registered in April.

A slower pace of recovery in the UK economy in 2022, according to April data from S&P Global, is partly owing to the weakest increase in new orders so far this year. The ‘cost of living issue‘ and economic uncertainty caused by the conflict in Ukraine had a negative influence on customer demand, according to a survey.

Chris Williamson, Chief Business Economist at S&P Global “Growth in the UK economy slowed dramatically in April due to a sudden drop in demand, according to the latest poll.”

UK economy relies heavily on the all-powerful consumer, which relies on a strong sense of trust in the market. There are several factors that contribute to growth and decrease in a service economy, such as consumer spending habits, corporate investment, and government spending.

“in nosedive as Index sinks in April to -38″ according to GfK’s report on consumer confidence in the United Kingdom. Surrealistically, 2008’s Great Financial Crisis last saw levels this high.

Joe Staton, GfK’s Client Strategy Director, adds that “the cost constraint is indeed impacting the purses of UK consumers, and the main confidence figure has fallen to a near-historic bottom,” he says. Moreover, retail sales for April were well below forecasts, with a month-on-month decrease of -1.4 percent, much below the predicted -0.3 percent and February’s -0.5 percent.

Bethany Beckett, UK Economist, at Capital Economics, said “Sales of retail goods fell sharply in March, continuing a two-month slide that suggests consumers are feeling the pinch of rising prices.”

Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics, said “Although retail sales volumes fell sharply in March, it seems to be the beginning of a long-term trend of decreased consumer spending.”

Because consumer confidence is at its lowest position since the epidemic and is only ebb above its historic low from July 2008, according to Tombs, families will only withdraw from their savings with extreme caution.

He further stated “According to our projections for the next months, we anticipate retail sales volumes to continue to decline as customers prioritize expenditure on services they had previously foregone due to the epidemic.”

The Bank of England will almost definitely review the rate at which it raises interest rates in the future in light of the weakening statistics. Due to the expectation that the Bank of England would increase interest rates more quickly and more aggressively than its counterparts, most notably the European Central Bank, the pound has appreciated in value from the end of 2021 and into early 2022.

To what far can the Bank hike rates in an economy already showing signs of strain? If the response is “not much” the pound is likely to suffer as financial markets reduce expectations for rate rises.

Simon Harvey, Senior FX Market Analyst at Monex, said “According to early PMIs out of Britain, the consumer is taking a beating right now, in accordance with retail sales this morning. The BoE’s pricing strategy is excessive in light of the current consumer environment.”

At the same time the bank is trying to keep inflation under control without sending the UK into a recession, governor Andrew Bailey said as much in a speech delivered late on Thursday. The Bank of Japan’s goal to control inflation at or below 2% has been shattered by a 30-year high of 7%, which is expected to rise to 9.0% in April.

Banks can’t do much about the basic causes of inflationary shock, such as oil prices and geopolitics, but inflation forecasts are currently a growing worry among UK residents and companies. This would need increased interest rates from the Bank of England.

Bank of England Monetary Policy Committee member Catherine Mann hinted Thursday that the Bank of England may raise interest rates by a substantial 50 basis points in May. But Friday’s statistics will put such a big move into question, eroding the Pound’s support.

Mikael Milhøj, Chief Analyst, at Danske Bank. said “As inflation continues to erode the spending power of consumers and the post-covid recovery becomes more difficult, we anticipate the UK economy to continue to grow, albeit at a slower rate.” According to recent predictions from Danske Bank, the Pound’s rise against the Euro is over.