The Euro to Dollar exchange rate (EURUSD) experienced significant downward pressure ahead of the weekend following the release of economic survey data that was described by one economist as “dreadful.” This has prompted economists to suggest that it may be an opportune time for the European Central Bank (ECB) to conclude its rate hiking cycle. According to S&P Global’s monthly PMI survey, the Eurozone’s economy flirted with contraction in June, with a decline in new business orders for the first time since January.

The Euro to Dollar exchange rate (EURUSD) experienced significant downward pressure ahead of the weekend following the release of economic survey data that was described by one economist as “dreadful.” This has prompted economists to suggest that it may be an opportune time for the European Central Bank (ECB) to conclude its rate hiking cycle. According to S&P Global’s monthly PMI survey, the Eurozone’s economy flirted with contraction in June, with a decline in new business orders for the first time since January.

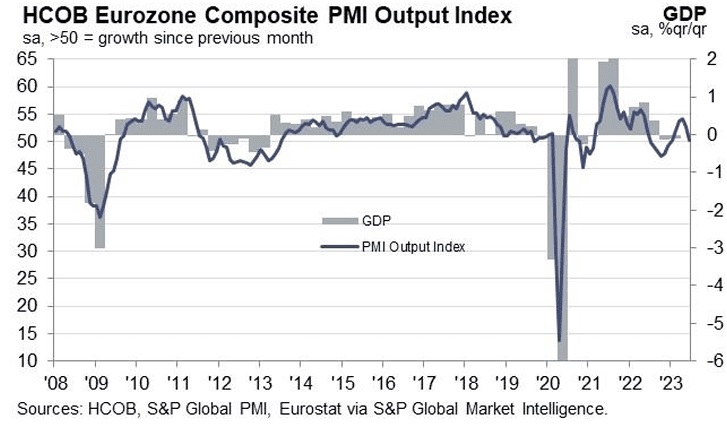

In June, the Services PMI came in at 52.4, falling below the market’s expected 54.5 and signaling a sharp slowdown from May’s impressive 55.1. Kenneth Broux, a strategist at Société Générale, states, “Euro extends drop to 1.4% from high of 1.1012 yesterday after dreadful PMIs.” The Manufacturing PMI recorded a reading of 43.6, pushing the sector further into contraction territory. The market had anticipated a reading of 44.8, aligning with May’s figure. The Composite PMI, which provides a better assessment of the broader economy, stood at 50.3, indicating it is on the brink of contraction. The market had expected a reading of 52.5, slightly lower than May’s 52.8.

France faced difficulties in June, with both manufacturing and services falling into contraction (45.5 and 48, respectively). Germany, known for its sizable manufacturing sector, also disappointed with a reading of 41, placing what was once Europe’s growth engine deeper into the contraction zone. At the time of writing, the Euro-Dollar rate has declined by 0.80%, bringing the pairing to 1.0866 and effectively ending the recent upward trend.

The Eurozone’s PMI survey revealed a further deterioration in new business trends across goods and services in June, as new orders dropped for the first time since January. This weakening demand environment signals downside risks to output in July, according to S&P Global. The report highlights manufacturing as a significant area of weakness for the Eurozone, with factory output falling for the third consecutive month and at the fastest rate since last October.

Although the service sector has been sustaining the economy thus far, its growth in output has significantly slowed as the recent surge in service spending loses momentum. Bert Colijn, Senior Economist for the Eurozone at ING Bank, remarks, “This suggests that the reopening boost to services activity is on its last legs at the moment, adding to the sluggish economic environment we’re currently in.”

The decline in the Euro aligns with the drop in Eurozone sovereign bond yields, indicating a retreat in market expectations for European Central Bank (ECB) rate hikes. Slowing inflation combined with a decelerating economy would give the ECB reason to reconsider the extent to which rates will need to rise. While at least one more rate hike is expected based on guidance from ECB Governing Council members, uncertainties arise regarding future hikes. However, Colijn states that none of this will prompt the bank to change its stance on rate hikes.

“Policymakers seem to prefer too much, rather than too little tightening right now, which sets the stage for another potential hike in September,” he says. Nevertheless, the slowing growth indicated by the Eurozone PMIs may raise doubts among market participants and put pressure on the Euro in the near term.

Holger Schmieding, Chief Economist at Berenberg Bank, warns that the Eurozone PMI data serves as a “stern warning for the ECB.” He suggests that after initially keeping its policy too loose for an extended period, the European Central Bank is now at risk of making the opposite mistake. Although the ECB has raised its growth projections for the Eurozone to 0.8% for 2023 and 1.5% for 2024, Schmieding argues that “underlying growth in the region is screeching almost to a halt.”

“It would be better for the ECB to pause soon and reassess the outlook for growth and inflation, as much of the impact of ECB rate hikes is still in the pipeline,” he adds. If the market perceives this as the likely trajectory for the Eurozone, it could put further pressure on the Euro.