The Canadian Dollar rose as the Canadian economy broke a trend of negative employment statistics in September by adding 21,100 jobs; nevertheless, some experts caution that the result was hardly a “home run.” This was above the consensus estimate of 20K, and a significant improvement over August’s -39.7K.

The Canadian Dollar rose as the Canadian economy broke a trend of negative employment statistics in September by adding 21,100 jobs; nevertheless, some experts caution that the result was hardly a “home run.” This was above the consensus estimate of 20K, and a significant improvement over August’s -39.7K.

Since a result of the figures, the Canadian Dollar strengthened versus the British Pound and other major currencies, as they signal the Bank of Canada is not yet in a position to contemplate halting its interest rate-hiking cycle. The fall in Canada’s unemployment rate conceals a potentially worrisome trend: according to Statistics Canada, the reduction is mostly the consequence of fewer individuals seeking job.

For the fourth consecutive month, year-over-year salary growth remained over 5%, with average hourly salaries of workers increasing 5.2% (+$1.57 to $31.67) compared with September 2021. For the Bank of Canada, the message is unmistakable: the labor market is tight, and wage rises are commensurate with high domestic inflation.

The low unemployment rate and robust wage growth justify the sustained hawkish tone of the Bank of Canada governor, according to CIBC Bank economist Andrew Grantham.

CIBC anticipates another 50 basis point increase from the Bank of Canada at its next meeting, but there are grounds to anticipate a pause. “Signs that a rising number of sectors are decelerating should prompt policymakers to adopt a more cautious stance,” adds Grantham.

The majority of new employment listed in Canada were in the public sector, particularly education, where seasonal factors were at play. “Outside of this sector, there was also a rise in the health care industry, but many other industries showed falls, an indication that rising interest rates and a slowing economy are pressuring the labor market,” adds Grantham. On this premise, the data release may not provide a lasting boost to the Canadian dollar.

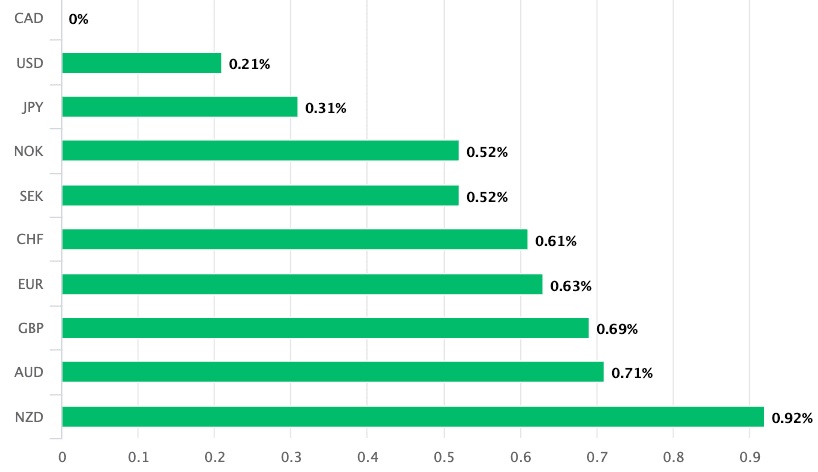

At the time of writing, the exchange rate between the British Pound and the Canadian Dollar (GBP/CAD) is 1.5283, down 0.3% on the day but up 2.0% on the month. For GBP/CAD payments, banks provide rates of roughly 1.4853, while specialized payment firms offer rates of approximately 1.5230. Against the Euro, the Canadian Dollar is up two-thirds of a percent on the day to 1.3380. Against the Dollar, the Canadian Dollar is up 0.20 percent as USD/CAD retreats to 1.3711. However, swings will be restricted owing to a robust U.S. employment data. The one positive light from the Bank of Canada’s standpoint, according to Andrew Kelvin, Chief Canada Strategist at TD Securities, was a slowdown in wage growth, which dipped to 5.2% in September from 5.6% in August.

In addition, the labor market is struggling to create employment; “with both the 3m and 6m trend in negative territory, this data points to a weakening economy, and a worse landing in early 2023 is becoming more probable,” he says. The strategists at TD Securities anticipate selling into the Canadian dollar’s gain. The data on the labor market comes only one day after BoC Governor Tiff Macklem cautioned the central bank was unable to reverse its program of interest rate hikes. In an address to the Halifax Chamber of Commerce, Macklem fought back against a “dovish pivot” (such as that used by the Reserve Bank of Australia this week) and downplayed the recent softening in the trend of CPI inflation.

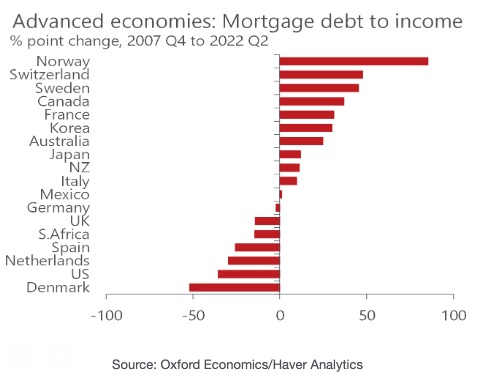

“He appears determined on making a bad position worse for Canadians in terms of debt payment,” says Mazen Issa, Senior FX Strategist at TD Securities, referring to Macklem’s hawkish tone. “If the Canadian CPI later this month confirms another data point of deceleration or at least stability in the core measures, the CAD will likely be finished,” he says. Canadian households are more indebted than families in other industrialized countries, therefore any increase in central bank interest rates would have a greater impact on them. It shows that the Canadian economy may be more susceptible to interest rate rises than other economies, meaning it might slow down more quickly.

According to Marc Desormeaux, Chief Economist at Desjardins Bank, “Ontario’s string of four straight monthly job losses underscores our belief that the province would be among the hardest-hit by the upcoming housing-driven Canadian recession.”

This creates downside risks for the Canadian dollar, as rate rises by the central bank, which were formerly helpful, may become plain unfavorable in the future. Kelvin states, “The combination of persistent hawkishness and lagging Canadian data indicates upside risk to our forecasted terminal rate of 4.25 percent, which in turn elevates the chance of a recession in 2023H1.”