The British Pound emerged as an unexpected beneficiary following the release of robust U.S. labor market figures, influencing investor expectations for the UK economy and the Bank of England’s (BoE) monetary policy decisions. Despite a significant drop in the Pound-Dollar exchange rate after the announcement of the strong U.S. job market report, the British Pound gained ground against most of its G10 counterparts.

The British Pound emerged as an unexpected beneficiary following the release of robust U.S. labor market figures, influencing investor expectations for the UK economy and the Bank of England’s (BoE) monetary policy decisions. Despite a significant drop in the Pound-Dollar exchange rate after the announcement of the strong U.S. job market report, the British Pound gained ground against most of its G10 counterparts.

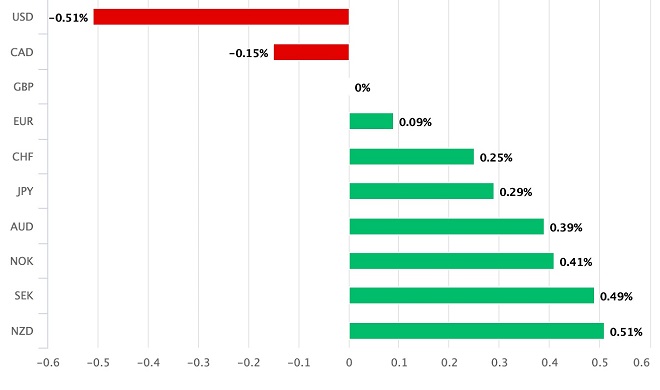

Notably, the Pound ranked as the third-best performing currency among the G10 nations, trailing only the U.S. Dollar and the Canadian Dollar, even as global stock markets experienced declines. The Pound to Euro exchange rate also saw a reversal of earlier losses, turning positive for the day after it was revealed that the U.S. economy added 272,000 jobs in May, up from 170,000 in April and surpassing the expected 180,000.

Furthermore, the Pound appreciated against the Swiss Franc, a safe-haven currency typically expected to gain during stock market selloffs. This market response indicated that the robust U.S. job data significantly reduced the likelihood of a U.S. interest rate cut in September, leading to broader speculation about the possibility of rate cuts in 2024.

The implications of the U.S. job market data extended to UK monetary policy, as the Pound’s rally suggested that investors anticipated a similar scenario unfolding for the BoE. Following the data release, market expectations for UK interest rate cuts in 2024 diminished, with less than two full rate cuts priced in. This was a stark contrast to the previous month’s expectations, which fully priced in a rate cut by August, with a 50/50 chance of a move as early as June.

UK inflation has remained stubbornly high, coupled with a resilient jobs market, mirroring trends observed in the U.S. economy. This resilience in the UK labor market has bolstered the outlook for the UK economy, suggesting continued improvement, especially if the U.S. economy maintains its momentum.

The positive correlation between the U.S. and UK economies was evident, as favorable developments for the U.S. Dollar had a beneficial impact on the British Pound. This interdependence highlighted the interconnected nature of global economies and the influence of major economic indicators on currency markets.

The British Pound’s performance against its G10 peers underscored the broader market sentiment that the BoE might need to maintain a tighter monetary policy stance, similar to the Federal Reserve, to manage inflation and support economic growth. The reduced likelihood of imminent rate cuts in the U.S. prompted reassessment of similar moves in the UK, further supporting the Pound’s strength.

In summary, the British Pound’s unexpected rise following the release of stronger-than-anticipated U.S. labor market data reflected investor confidence in the UK economy and the BoE’s policy outlook. This development emphasized the significant impact of global economic data on currency markets and underscored the importance of cross-border economic interconnections. As the UK economy continues to show signs of resilience, influenced by trends in the U.S., the Pound is likely to remain buoyant amid evolving market expectations for monetary policy adjustments on both sides of the Atlantic.