The Australian Dollar is the best-performing major currency at the dawn of the new week, a trend that corresponds with increased freedoms in Sydney, and which some foreign exchange experts believe will continue to rise. “The Australian dollar is outpacing most top currencies,” says Elias Haddad, Senior Currency Strategist at the Commonwealth Bank of Australia.

The Australian Dollar is the best-performing major currency at the dawn of the new week, a trend that corresponds with increased freedoms in Sydney, and which some foreign exchange experts believe will continue to rise. “The Australian dollar is outpacing most top currencies,” says Elias Haddad, Senior Currency Strategist at the Commonwealth Bank of Australia.

Even though the lifting of Sydney and other regions of New South Wales had been anticipated by the foreign exchange market for some time and is therefore reflected “in the price” of the currency, the Australian Dollar’s outperformance nonetheless indicates a more optimistic outlook for the domestic economy.

After almost four months of closure, customer-facing companies in Sydney reopened their gates to totally vaccinated clients on Monday, a move that analysts predict will help the city’s economic growth return to growth mode. This momentum will increase later in the month when the state of Victoria opens its doors in a similar fashion to the rest of the country.

The Australian dollar to the United States dollar (AUD/USD) is now trading at 0.7335, up 0.40 percent on the day. The exchange rate between the pound and the Australian dollar (GBP/AUD) is now at 1.8563, down 50% on the day. Haddad, on the other hand, believes that increasing global energy and base metal prices are acting a more supporting role for the Australian Dollar at the beginning of the fresh week than previously thought.

Both China and India, the world’s two most important coal users, are suffering from a severe shortage of thermal coal, which Australia has in large quantities. According to Reuters, China’s Liaoning province has cautioned that in spite of attempts to import additional coal to increase power supplies, the province may face a 4.74GW power shortage this coming week.

Heavy rains have also forced the closure of about 60 Chinese coal mines, as well as the closure of rail links owing to floods. In the meantime, 50% of India’s 135 coal-fired power plants, which generate 70% of the country’s energy, are reported to have coal supplies for lower than three days, according to the Indian Energy Ministry.

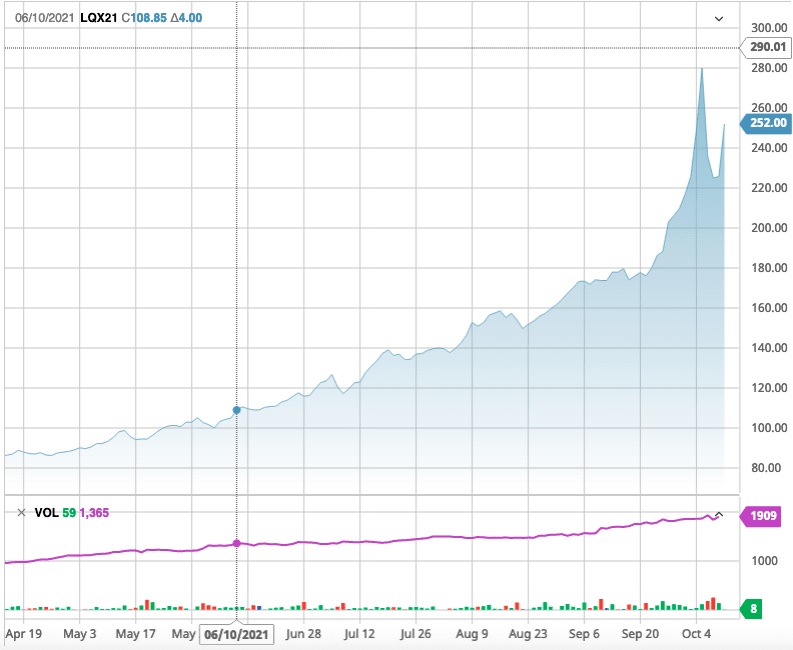

The overall result is an increase in the price of Australia’s benchmark Newcastle coal, which is now commanding a record high:

Additionally, both Asia and Europe are embroiled in a fierce bidding war for natural gas, which has resulted in record-breaking prices for the commodity.

Given that coal and natural gas are Australia’s second and third most valuable exports, the nation stands to gain as a result of the agreement.

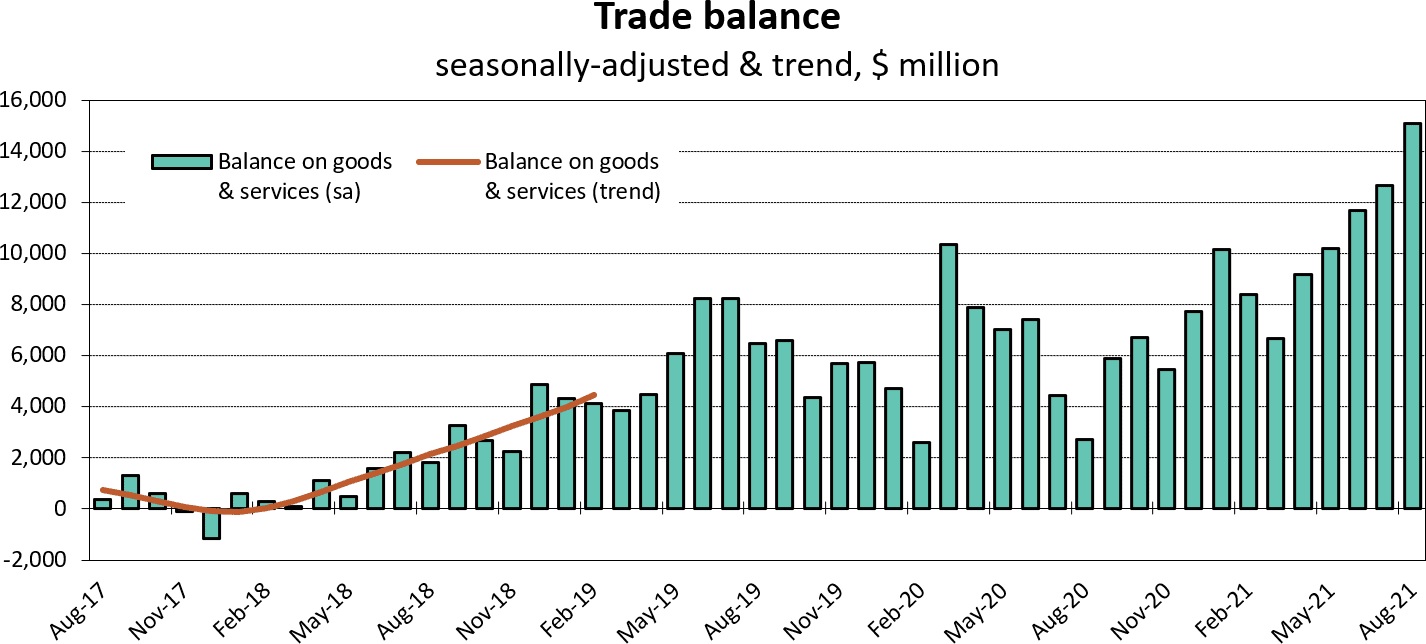

According to official figures, Australia achieved an unprecedented trade surplus in August as demand for coal and natural gas soared. Additional gains are expected to have been earned in September and October as coal and natural gas prices continue to rise.

Westpac currency experts have said that the fair value of the Australian dollar has increased in reaction to the soaring trade surplus. Another factor contributing to the Australian Dollar’s outperformance is the increasing anticipation that interest rates at the Reserve Bank of Australia (RBA) would increase as early as 2022.

“In spite of the Reserve Bank of Australia’s (RBA) assurance that it would not increase the cash rate (now at 0.10%) until 2024, Australian interest rate futures continue to push forward bets on rate rises,” writes Haddad.

The OIS curve for Australia predicts a cash rate of 0.25 percent by the end of 2022, 0.90 percent by the end of 2023, and 1.40% by the end of 2024. For its part, the Reserve Bank of Australia (RBA) has remained strong in its assertion that interest rate increases are unlikely until 2024, indicating a substantial divergence between RBA advice and the market’s view.

It is anticipated that the reopening on Monday of Australia’s foremost economically valuable state of New South Wales would contribute to this anticipation being realized. After almost four months of closures, client-facing companies reopened their doors to totally vaccinated consumers on Monday, a move that analysts predict will help to push the economy back into growth mode.

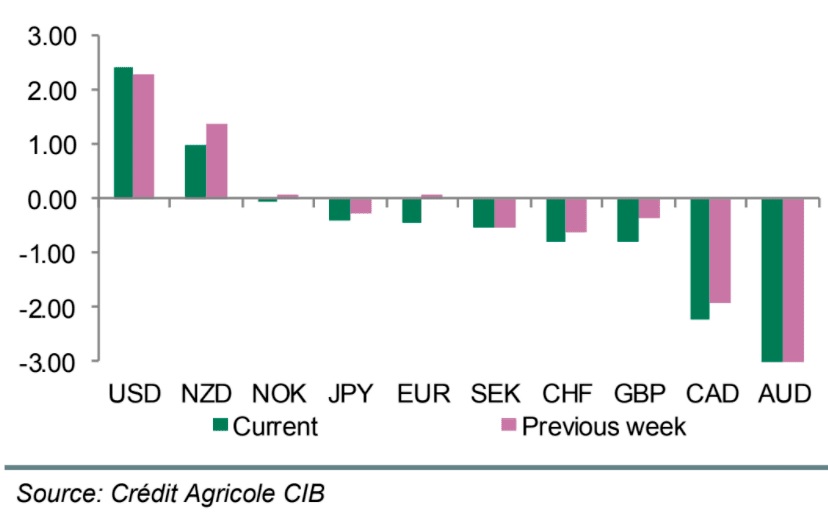

This momentum will be increased later in the month when the state of Victoria opens its doors in a similar fashion to the rest of the country. In addition to positioning, the Australian Dollar’s outperformance seems to be aided by the fact that wagers against the Aussie have become one of the most prominent among foreign currency market players in the last few months.

The problem with prolonged positioning – as is the scenario with the Aussie in the chart above – is that it may frequently become a headwind in and of itself. If the possibility of a reversal increases, the likelihood of such a move increasing, and such movements may be very sharp, is increased.

In the case of the Australian Dollar, wiping out such bets on the downside will almost always need the purchase of Australian Dollars in order to settle the appropriate transactions. Strategists at Crédit Agricole said one of their simulations is now suggesting that investors purchase Australian Dollars, indicating that the AUD/USD may rise by up to 3.0% in the near future.

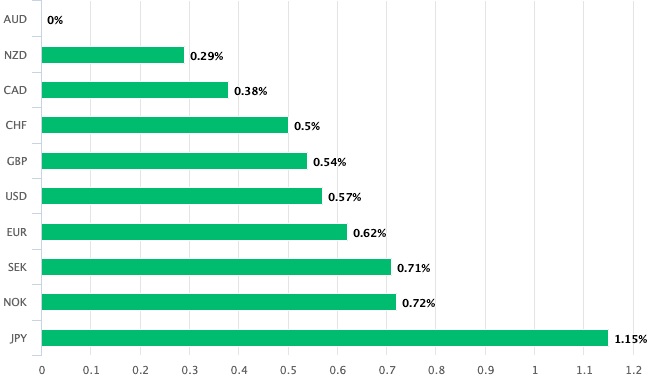

Valentin Marinov, Head of G10 Forex Strategy at Crédit Agricole, says the Australian dollar is by far the most oversold of the G10 currencies at the moment and that the scenario has changed little over the last week.

Technically, the next targets for the AUD/USD pair are 0.7454, 0.7548 and 0.7621.