Leverage in Forex Trading Explained

You are going to be going on something of a sharp learning curve as soon as you have an interest in becoming a Forex trader. However, we do have lots of trading guides which are going to allow you to get a much clearly understanding of every aspect of trading currencies online here at the Traders Bible website.

You are going to be going on something of a sharp learning curve as soon as you have an interest in becoming a Forex trader. However, we do have lots of trading guides which are going to allow you to get a much clearly understanding of every aspect of trading currencies online here at the Traders Bible website.

In this guide we are going to be taking a look at Forex Leverage, which is an important aspect of you placing Forex trades.

With that in mind please do have a good read through of this guide to leverage, and also make use of our additional guides which compliment this one, as by doing so you will soon get a much clearer understanding of the world of Forex trading.

What is Forex Leverage?

One of the main differences between trading Forex and any other type of asset or commodity is that the leverage you can achieve on the Forex and currencies markets is the very highest that any trader is going to be able to access.

Leverage in its most basic form is best described as a loan which is going to be offered to a Forex trader by one of the many different brokers you can sign up to and use the services of.

There are several different leverage amounts that are going to be made available to you at different Brokers, however the average amounts offered to online Forex traders’ are usually one of three amounts which are 50:1, 100:1 and 200:1.

By making use of that leverage as a trader you are going to be able to place trades that are worth up to a maximum of 200 hundreds times the amount you have available in your trading account, and as such your are going to be getting something of a much more fluid trading account balance when making use of leverage.

However, it is worth noting that the actual amount of leverage that will be made available to you will vary in regards to one of several different factors. It will often be the case that the Forex Broker you have chosen to sign up to as a client will determine the exact amount of leverage you will be able to make use of, and also the type of trades you are looking to place with that Broker.

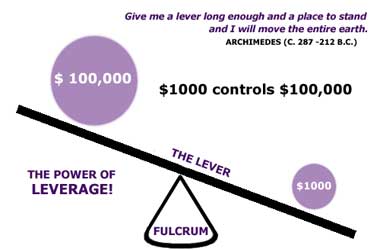

If you for example find a Broker offering you a leverage of 100:1 then you are going to be able to trade with that Broker on either their mobile or online trading platform, or even over the telephone if a telephone trading service is available up to $100,000 of currency with just $1000 in your account.

One thing to keep in mind is that you may think that placing such a huge value of trades is going to be very risky and could see you making some substantial losses if things do not go as planned on your chosen trades.

As it is often the case the currency values often only swing in value of around 1% over the course of most days the level of risk will not be as large as you first thought.

Leverage and Trading Strategies

If you are interested in becoming a Forex trader then there are lots of ways that you are going to be able to do so whilst keeping the element of risk on each trade you place to an absolute minimum.

The aim of any Forex trader is of course to make continued profits, however all traders will experience losing trades.

With that in mind we invite you to now make use of some of our Forex strategy trading guides which will allow you to discover ways that you can reduce your element of risk no matter what types of Forex trades you do decide to place online.

We have plenty of forex trading strategy guides available to you on this website and they are going to help you manage your risk and also become something of a much more structure Forex trader when you make use of them.

The one aspect to any successful Forex Trader you will often find is that they have in place and rigidly stick to a very well thought out trading strategy and one on which they always know the element of risk is being kept to a minimum and one that allows them to have a good idea of how much they could make in profits over one or more trading session.