As the weekend approached, the British Pound gained strength, bolstered by the news that the UK’s economy experienced greater growth in the first quarter of this year than initially estimated. This positive adjustment was attributed to the combined effects of rising incomes and falling inflation. Newly released statistics indicated that the UK Gross Domestic Product (GDP) expanded by 0.7% quarter-on-quarter in Q1, surpassing the earlier Office for National Statistics (ONS) estimate of 0.6%. On an annual basis, the economy grew by 0.3%, an improvement over the previous estimate of 0.2%.

As the weekend approached, the British Pound gained strength, bolstered by the news that the UK’s economy experienced greater growth in the first quarter of this year than initially estimated. This positive adjustment was attributed to the combined effects of rising incomes and falling inflation. Newly released statistics indicated that the UK Gross Domestic Product (GDP) expanded by 0.7% quarter-on-quarter in Q1, surpassing the earlier Office for National Statistics (ONS) estimate of 0.6%. On an annual basis, the economy grew by 0.3%, an improvement over the previous estimate of 0.2%.

Impact of Rising Incomes and Falling Inflation

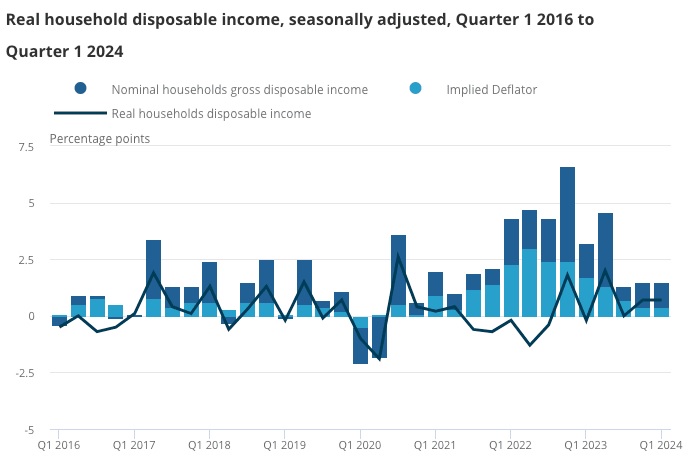

Economic analysts pointed out that the reduction in inflation outpacing wage growth contributed to the rise in real household disposable incomes (RHDI), which in turn supported the economy. The ONS reported that RHDI grew by 0.7% quarter-on-quarter, matching the growth rate of the previous quarter, which was considered a robust pace of income growth. Economic experts noted that the economy rebounded strongly from the previous year’s recession and suggested that the Bank of England might delay an anticipated interest rate cut in August due to the strong economic growth.

Strengthening Pound Sterling

Pound Sterling had faced a period of weakness in recent days, but the positive GDP data helped the currency gain strength against both the Euro and the Dollar. This development occurred ahead of a week filled with potential risks, including elections in France and the UK. Analysts indicated that the robust economic growth might lead to a delay in the Bank of England’s interest rate cut, predicting that growth exceeding potential in the first half of 2024 could prompt the Monetary Policy Committee (MPC) to reconsider their decision. Market pricing suggested that the odds of an August rate cut were around 50/50.

Future Economic Outlook

Looking ahead, economic projections for 2024 emphasized the significance of consumer activity. Real household disposable income was expected to rise by 2.2% in 2024, driven by slowing inflation and strong wage growth. Additionally, cuts to National Insurance Contributions and government adjustments to benefits in line with the previous year’s inflation were anticipated to contribute an additional 0.8 percentage points to real disposable income growth. This increase in income was expected to translate directly into consumer spending.

Implications for Monetary Policy

The minutes from the Bank of England’s June meeting revealed that several members of the MPC were undecided about maintaining the current interest rates, suggesting they were close to implementing a cut. However, a robust economy with rising real incomes was expected to sustain demand sufficiently to counter further declines in inflation. As a result, the MPC might delay cutting the Bank Rate until September, considering the continued strong economic performance.

In summary, the revised GDP figures and the consequent rise in the British Pound underscored the positive economic trajectory of the UK. The interplay of rising incomes, falling inflation, and strong consumer spending were pivotal factors in this growth, influencing both market expectations and monetary policy decisions. The developments highlighted the resilience of the UK economy and the potential challenges and considerations facing the Bank of England in its future policy deliberations.