The latest US jobs report has had a significant impact on dollar exchange rates, with indications of softening prompting speculation about a potential Federal Reserve rate cut.

The latest US jobs report has had a significant impact on dollar exchange rates, with indications of softening prompting speculation about a potential Federal Reserve rate cut.

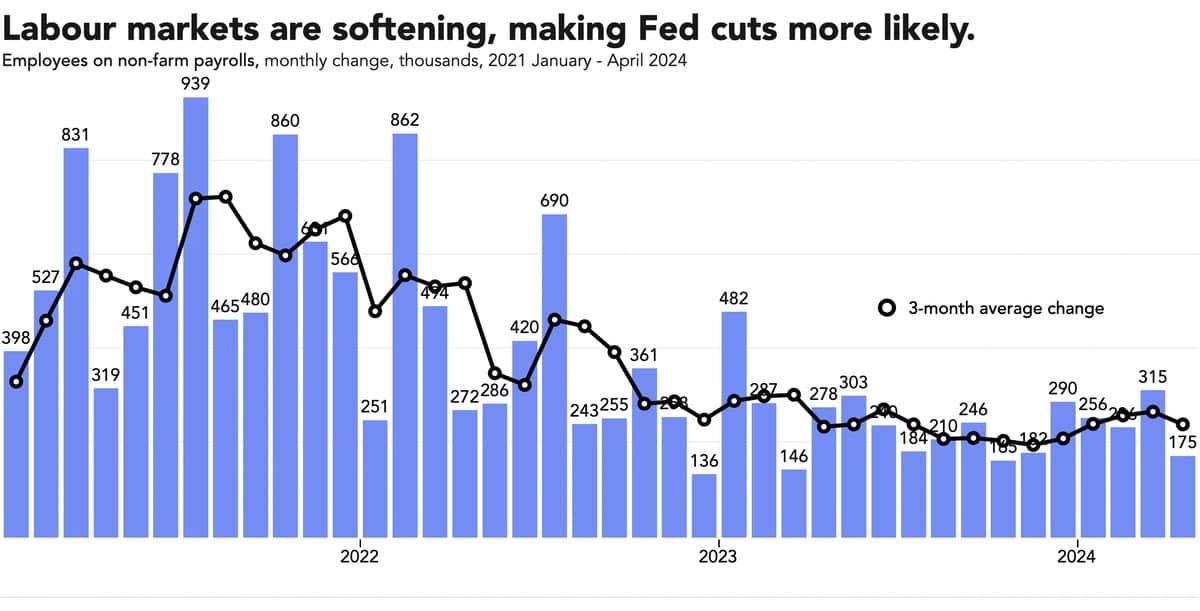

Following the release of the April non-farm payrolls report by the Bureau of Labor Statistics (BLS), the Pound to Dollar exchange rate surged above 1.26, marking a 0.54% increase. The report revealed a rise of 175K jobs in April, a decrease from March’s figure of 315K, falling short of expectations set at 238K.

Unexpectedly, the unemployment rate inched up to 3.9% from the previous 3.8%, while average hourly earnings saw a 0.2% increase month-on-month, down from the previous month’s 0.3% and below the expected 0.3%. Additionally, the year-on-year earnings rate dropped from 4.1% to 3.9%.

Paul Ashworth, Chief North America Economist at Capital Economics, commented on the report, noting that the weaker performance across various metrics has reignited discussions about potential rate cuts by the Federal Reserve, given the easing in the labor market.

The US dollar experienced a 0.60% decline against the Euro (EUR/USD 1.0790) and suffered more significant losses against currencies like the Australian Dollar (AUD/USD 0.6634, +1.0%) and the New Zealand Dollar (NZD/USD 0.6032, +1.20%).

Market dynamics, heavily influenced by the US economy and Federal Reserve rate expectations, have led to the outperformance of ‘high beta’ currencies such as the Australian and New Zealand Dollars over currencies like the Pound and Euro. The overall sentiment has also bolstered stocks and bonds, resulting in decreased bond yields and borrowing costs.

The current data has tilted the market in favor of a weakened dollar, benefiting assets typically favored during periods of improved investor sentiment. The next significant indicator for the dollar will be the mid-month release of US inflation data, with any shortfall likely reinforcing the pro-risk/USD-negative scenario.

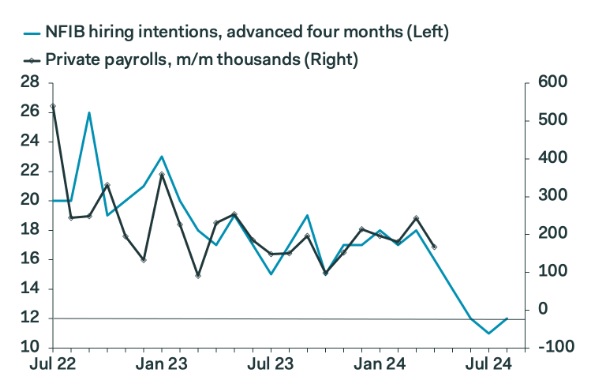

According to analysis by Pantheon Macroeconomics, the US employment landscape is anticipated to further weaken in the upcoming months. Chief Economist Ian Shepherdson notes that the NFIB survey of employment has consistently foreshadowed official employment figures, signaling a clear downward trend ahead.

Pantheon Macroeconomics forecasts a 100-basis-point easing by the Federal Reserve this year, beginning in September, a more aggressive projection than what the market currently anticipates. If realized, this could further pressure the dollar’s value.