In a recent update, Apollo Global Management, a major American money manager, has revised its outlook, suggesting that the Federal Reserve is unlikely to cut interest rates throughout 2024. This projection, if accurate, holds significant consequences for financial markets, especially considering initial expectations for six Fed rate cuts in 2024.

In a recent update, Apollo Global Management, a major American money manager, has revised its outlook, suggesting that the Federal Reserve is unlikely to cut interest rates throughout 2024. This projection, if accurate, holds significant consequences for financial markets, especially considering initial expectations for six Fed rate cuts in 2024.

Market Realities Challenge Initial Assumptions

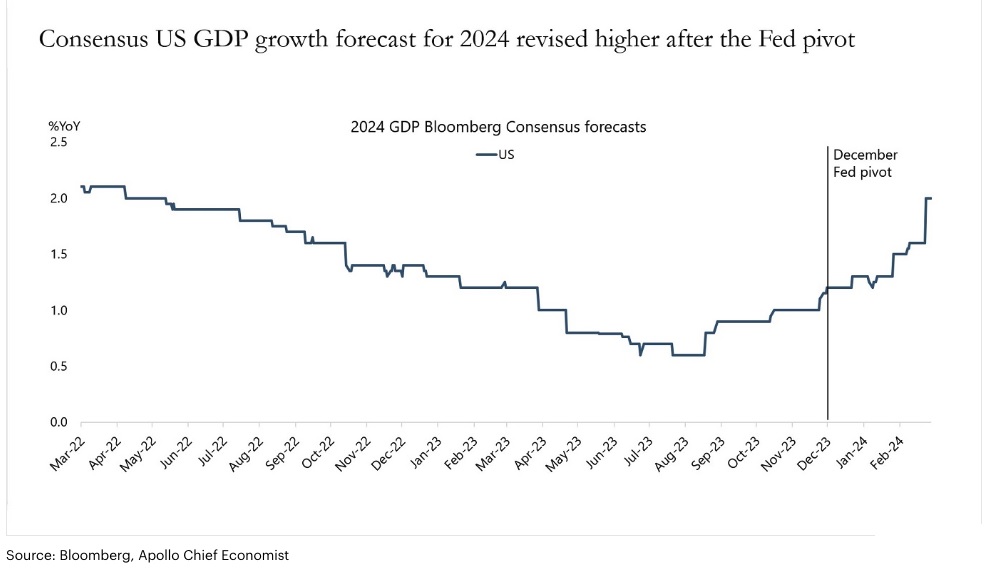

Apollo’s Chief Economist, Torsten Sløk, highlights the robustness of the U.S. economy, dispelling notions of an imminent slowdown. Sløk emphasizes, “The reality is that the US economy is simply not slowing down, and the Fed pivot has provided a strong tailwind to growth since December.” This perspective aligns with the market shift in January and February, acknowledging the strength of the U.S. economy and recalibrating expectations to just three anticipated rate cuts.

Economic Landscape and Fed Pivot

Sløk’s reference to the Fed’s December meeting underscores a pivotal moment when the central bank acknowledged the possibility of future rate cuts. The resultant adjustment in money markets contributed to lower U.S. Fed rates, impacting bond yields and overall cost of money.

Economic Indicators Support the Projections

Underlying economic indicators support Apollo’s stance. Sløk points out the reacceleration of the U.S. economy, citing rising growth expectations for 2024 following the Fed’s pivot. He notes easing financial conditions, illustrated by record-high issuance in investment-grade and high-yield markets, increased IPO and M&A activities, and a thriving stock market.

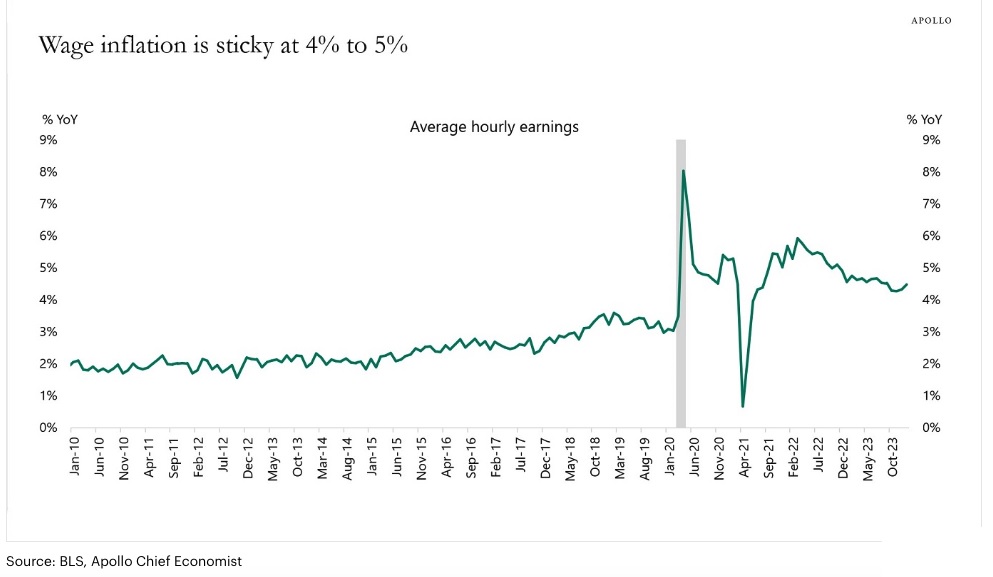

Inflation and Labor Market Dynamics

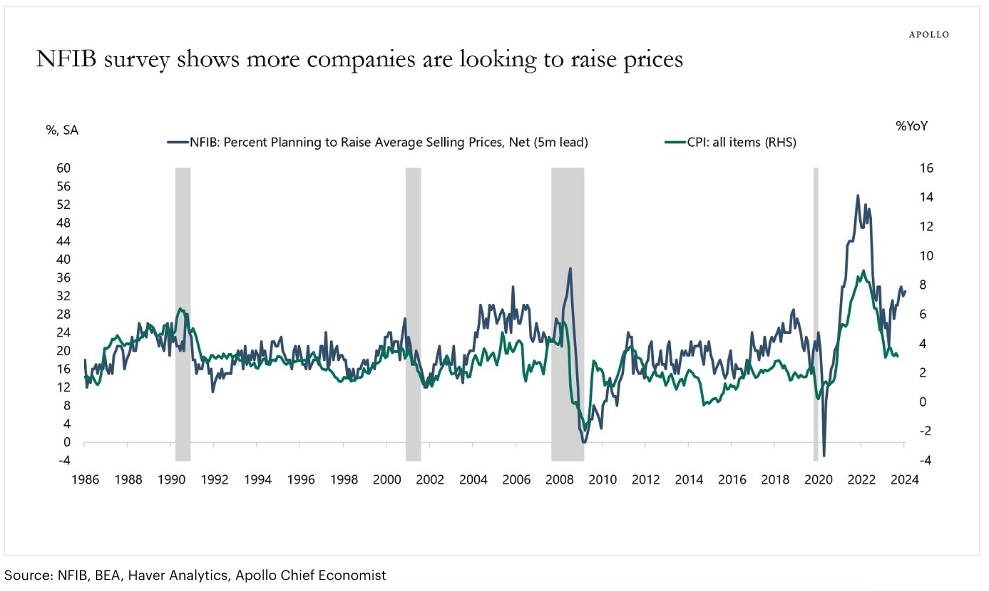

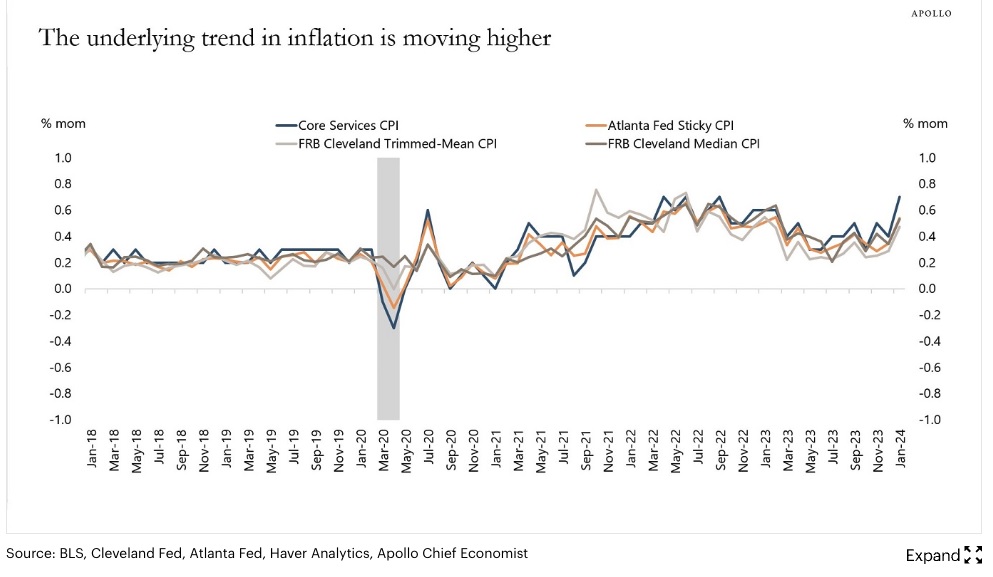

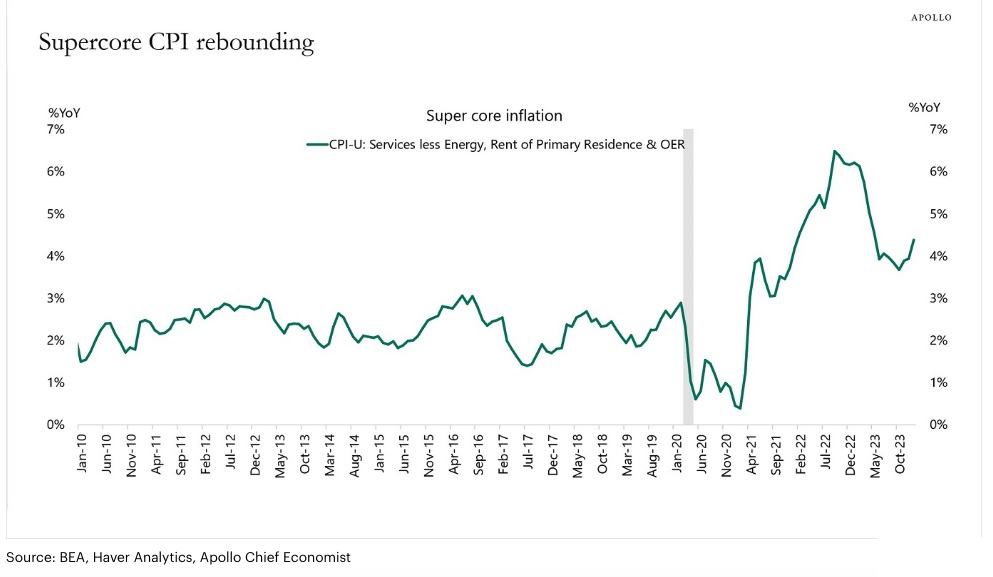

Sløk highlights the upward trend in measures of inflation, particularly emphasizing Fed Chair Powell’s preferred metric, supercore inflation. The tight U.S. labor market, low jobless claims, and persistent wage inflation between 4% and 5% reinforce the argument that the economy needs to ‘loosen’ before inflation rates can subside.

Warning Signs in Various Sectors

Apollo’s analysis extends to various sectors, including housing, where rising rents and home prices challenge the narrative of an impending rate cut. Sløk asserts, “Asking rents are rising, and more cities are seeing rising rents, and home prices are rising,” indicating potential inflationary pressures.

Global Implications and Market Dynamics

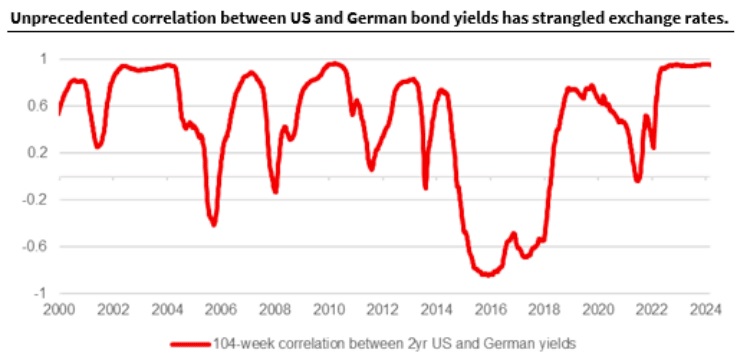

While the Dollar has emerged as the best-performing currency in 2024 amid diminishing rate cut expectations, FX market movements have been relatively restrained. However, the article suggests that a complete abandonment of Fed rate cut expectations could introduce volatility, tighten financial conditions, and potentially trigger a stock market selloff that bolsters the Dollar as a safe-haven currency.

Global Central Banks and Potential Divergence

The article explores the likelihood of other central banks delaying rate cuts alongside the Fed, highlighting the potential challenges faced by institutions such as the Bank of England and the European Central Bank. The timing of rate adjustments could impact currency pairs, with Euro-Dollar potentially facing greater downside potential compared to Pound-Dollar.

Conclusion: March Reports Awaited for Validation

The validity of Apollo’s projections hinges on upcoming critical reports, particularly March’s U.S. labor market and inflation reports. A confirmation of these projections could signal a shift in market sentiment, ending the current low-volatility phase in the FX market.