In a noteworthy turn of events, the British Pound experienced volatility following the Bank of England’s decision to maintain existing interest rates while subtly hinting at the possibility of a future rate cut. The central bank effectively communicated its expectation of a lower interest rate in the future, carefully managing market sentiments to prevent premature speculation and excess betting on an imminent rate cut.

In a noteworthy turn of events, the British Pound experienced volatility following the Bank of England’s decision to maintain existing interest rates while subtly hinting at the possibility of a future rate cut. The central bank effectively communicated its expectation of a lower interest rate in the future, carefully managing market sentiments to prevent premature speculation and excess betting on an imminent rate cut.

Navigating the Communication Challenge:

Governor Andrew Bailey successfully conveyed the message that interest rates would remain unchanged for an extended period, emphasizing that a rate cut would only be considered when there is clarity on inflation settling at the 2.0% target. Acknowledging the potential challenges of signaling a policy shift, particularly for a bank historically challenged in communication with investors, the Bank of England aims to avoid unintended consequences in financial markets.

Market Adjustments and Rate Cut Expectations:

Money market pricing reflected a shift in investor expectations, with a reduction in bets for the first rate cut, potentially moving it beyond May, aligning with the Bank’s commitment to a ‘higher for longer’ stance. The Pound, one of 2024’s top-performing major currencies, benefited from the diminishing rate cut expectations that had accumulated in the latter stages of 2023.

Pound’s Exchange Rate Dynamics:

The Pound to Euro exchange rate exhibited volatility, reacting to the Bank’s decision, while the Pound to Dollar exchange rate also experienced fluctuations. Despite the noise in the market, attention remains on the 1.27 level in the Pound to Dollar exchange rate.

Potential Underestimation of Bank’s Resolve:

Market analysts suggest that there may be underestimation in the market regarding the Bank of England’s commitment to holding interest rates steady. Ales Koutny, Head of International Rates at Vanguard, noted that markets might not be fully attentive to the subtle shift in the Bank’s rhetoric, emphasizing the possibility that the Bank could be cautious even in implementing rate cuts.

Shift in Policy Focus and Pound’s Strength:

According to Lee Hardman, Senior Currency Analyst at MUFG, the policy focus has shifted from a readiness to hike rates to evaluating the duration rates need to be held at the current level. The Pound’s strength in response to the Bank’s decision suggests a market perception that the Bank is not likely to lower rates as quickly as expected in May.

Expectations for Sterling’s Performance:

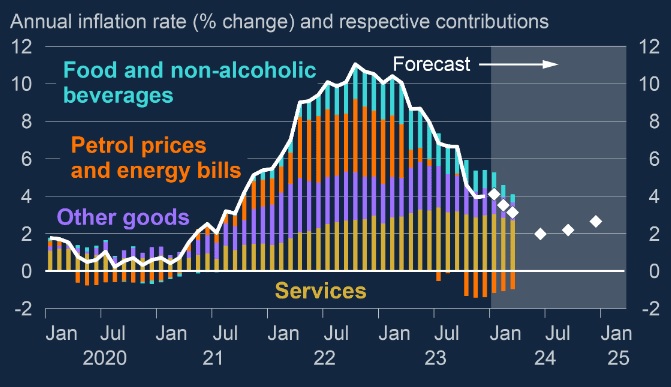

MUFG maintains a recommendation to buy the Pound against the Euro, anticipating that Sterling will benefit from the Bank of England lagging behind the ECB in the interest rate cutting cycle. The Bank of England, while acknowledging elevated inflation risks, expects inflation to end the year closer to 3.0%.

Broader Support for the Pound:

Georgette Boele, Senior FX Strategist at ABN AMRO, anticipates that if the Bank of England cuts less than the Fed and the ECB in 2024, the Pound is likely to perform well. The overall sentiment suggests that the Pound is expected to remain supported as long as the Federal Reserve and Bank of England resist rate cuts, with the relationship between these two central banks being a crucial factor influencing the GBP outlook.