Capital Economics, an independent research company, has signaled a bearish outlook for the British Pound against the U.S. Dollar despite its robust start to 2024, where it competes for the top spot in the G10 complex alongside the dollar.

Capital Economics, an independent research company, has signaled a bearish outlook for the British Pound against the U.S. Dollar despite its robust start to 2024, where it competes for the top spot in the G10 complex alongside the dollar.

Factors Behind the Sterling’s Current Performance

The favorable standing of the British Pound and the U.S. Dollar is attributed to a shift in expectations regarding the timing and scale of potential rate cuts from the Bank of England and the U.S. Federal Reserve in the coming months.

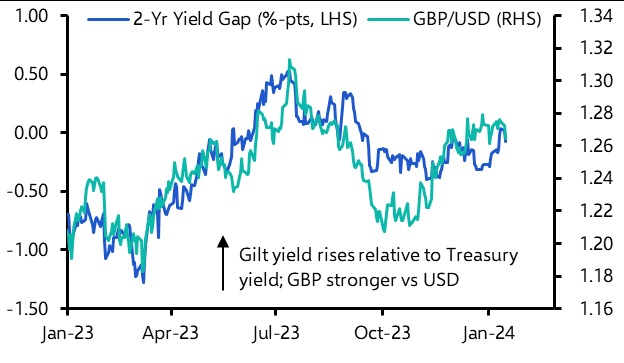

Although the Pound has displayed resilience against other G10 currencies, Jonathan Petersen, Senior Markets Economist at Capital Economics, suggests that this strength is likely to be short-lived. He emphasizes that much of the Pound’s current resilience is tied to the shift in short-term yields, particularly the 2-year yield gap between the U.S. and the UK.

Monetary Policy Outlook for the UK and the U.S.

According to Petersen, the key factor behind the anticipated decline in the Pound against the U.S. Dollar is the differing outlooks for monetary policy in the UK and the U.S. He notes that the expectation of inflation reaching the central bank’s target in the UK before other major developed economies is a significant driver.

The year 2024 has witnessed a significant reassessment of UK inflation forecasts, with projections suggesting a potential fall to the Bank of England’s 2.0% target as early as April. This development positions the Bank of England to consider interest rate cuts, possibly in June or earlier if economic indicators point towards a sub-2.0% outcome.

Interest Rate Expectations and Overvaluation Concerns

Petersen predicts a shift in the short-term yield gap in favor of the U.S. Dollar, aligning with Capital Economics’s forecast for the US policy rate, which is broadly in line with market expectations. This shift, coupled with concerns about the Pound’s current overvaluation, leads to the conclusion that there is “plenty of scope to fall.”

Capital Economics maintains its forecast for the GBP/USD rate to decline to 1.20 by the end of the year, down from approximately 1.26 at present. Despite the Pound’s positive performance against some G10 currencies, the research company’s long-term projection emphasizes the challenges ahead, underscoring potential headwinds for Sterling in the evolving global economic landscape.