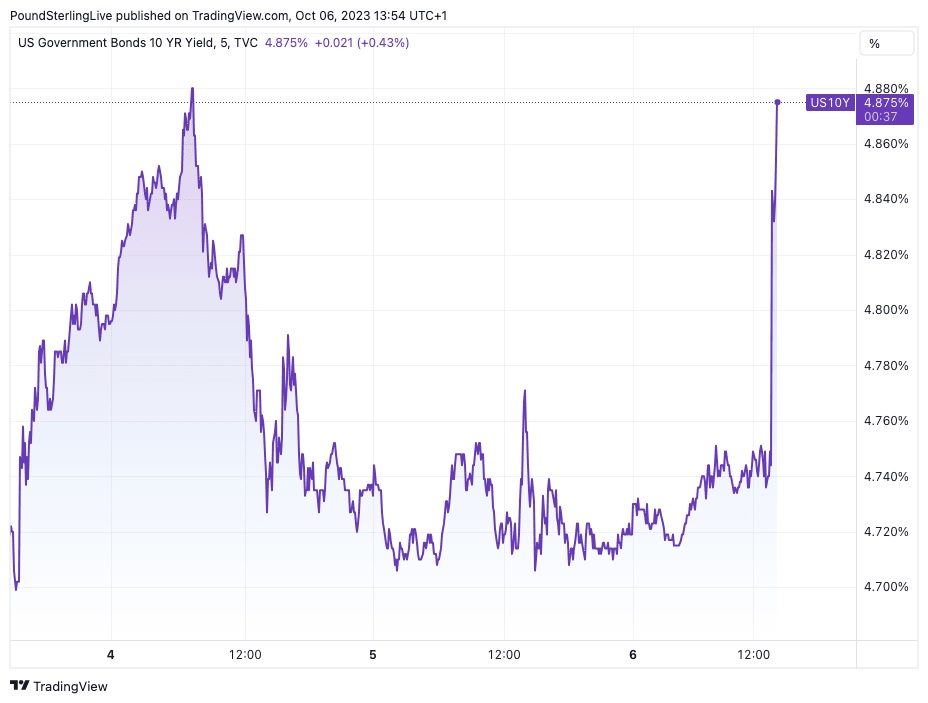

The US Dollar surged in response to a robust September jobs report, causing treasury yields to rise while stock markets faced a decline. This unexpected strength in employment figures has increased the likelihood of additional interest rate hikes by the US Federal Reserve before the end of the year.

The US Dollar surged in response to a robust September jobs report, causing treasury yields to rise while stock markets faced a decline. This unexpected strength in employment figures has increased the likelihood of additional interest rate hikes by the US Federal Reserve before the end of the year.

Positive Job Report Signals Economic Resilience:

Economists, including Ali Jaffery of CIBC Bank, have noted that the September US jobs report demonstrates the remarkable resilience of the US economy, defying earlier expectations. The report indicated that 336,000 new jobs were created in September, surpassing the market’s anticipated figure of 171,000.

Market Reactions:

The Pound to Dollar exchange rate experienced a drop of more than half a percent, reaching a daily low of 1.2117, following the release of the Bureau of Labor Statistics’ report. Fawad Razaqzada, a Market Analyst at City Index, observed that the US Dollar initially strengthened, while index futures recorded significant declines, as the data suggested the possibility of prolonged high-interest rates.

The Euro also faced downward pressure, falling below 1.05 to trade at 1.0490, as the Dollar witnessed broad-based demand. Simultaneously, the ten-year treasury yield surged to 4.85%, reigniting concerns about potential financial instability due to the rapid increase in borrowing costs.

Implications for Interest Rates:

Mohamed A. El-Erian, President of Queens’ College at Cambridge University and advisor to Allianz, emphasized that the substantial job creation surprise, coupled with widespread gains, could lead to a sell-off in both stocks and bonds. He noted that the Federal Reserve’s data-dependent approach may put an interest rate hike back on the table for the markets on November 1.

Dollar as a Safe Haven:

The decline in stock markets typically bolsters the demand for the ‘safe haven’ US Dollar, further intensified by rising bond yields.

Earnings and Monetary Policy Outlook:

Although the Average Hourly Earnings data showed a slight weakness at 0.2% month-on-month, compared to the expected 0.3%, the year-on-year rate remained at 4.2%, slightly below the expected 4.3%. This is seen as positive for the Federal Reserve’s stance on monetary policy.

Oliver Rust, Head of Product at independent inflation data aggregator Truflation, cautioned about potential revisions in the coming month and noted that the lower-than-expected wage growth does not significantly increase the likelihood of another rate hike before the end of the year. The strength of the labor market, despite the Federal Reserve’s aggressive monetary tightening, suggests that looser monetary policies may not be on the horizon.

Dollar’s Continued Strength and Market Dynamics:

The Dollar is expected to maintain its ascendancy, given that the data strongly supports expectations of ‘higher for longer’ US interest rates, which have driven its upward trajectory since July.

For currencies like the Pound, Euro, and others in the G10, continued pressure is likely until economic data unexpectedly starts to weaken, signaling a cooling economy, or until the rise in bond yields begins to pose challenges in various segments of the financial market. The impact of the strong jobs report on market dynamics underscores the importance of vigilance and adaptability in a rapidly changing economic landscape.