Economic Indicator Signals Worrying Contraction

Economic Indicator Signals Worrying Contraction

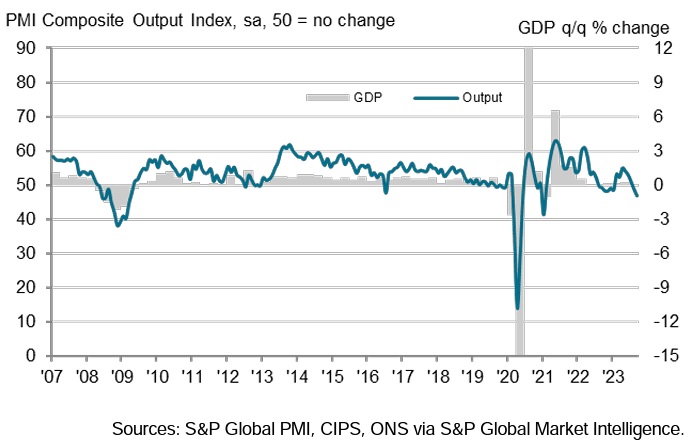

The British Pound has witnessed a continuous decline over several weeks as survey data indicates a substantial slowdown in the UK economy, surpassing anything observed since the onset of the Covid-19 lockdown. According to the S&P Global Composite PMI, which fell from 48.6 in August to 46.8 in September, the UK economy is currently experiencing a contraction, as any reading below 50 signifies. These findings align with an economy that is showing signs of reversal.

This development had been hinted at during the recent Bank of England Monetary Policy Committee meeting, which ultimately led the MPC to vote in favor of maintaining the current interest rates at 5.25%. As Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, noted, “With the Bank of England having had sight of the survey data prior to its latest policy decision, the worrying signals from the survey of heightened recession risk and cooling inflationary pressures are likely to have added to calls to halt rate hikes.”

Sectoral Analysis

Examining the report’s components, the largest sector of the UK economy, services, recorded a PMI of 47.2, falling short of expectations set at 49.2 and below August’s 49.5. Manufacturing, on the other hand, continued to experience contraction with a PMI of 44.2, albeit slightly higher than the reading of 43 recorded in August.

Following the release of this data, the Pound to Dollar exchange rate (GBPUSD) stood at 1.2246, marking a 0.40% decline for the day. Similarly, the Pound to Euro exchange rate (GBPEUR) registered a rate of 1.1511, down by 0.18% on the day. These losses further compounded the significant declines observed following Thursday’s Bank of England decision.

Market Expectations and Analysis

James Smith, Developed Markets Economist at ING, expressed his concern, stating, “It’s another dismal outcome.” He went on to predict that the Bank of England would maintain its current stance in November, emphasizing that August’s rate hike marked the peak of the tightening cycle.

The market appears to be betting on the UK heading towards a recession and expects the Bank of England to swiftly lower interest rates, possibly as early as May 2024, despite anticipated elevated inflation levels. By selling the Pound against the Euro and the Dollar, markets are effectively signaling that the UK’s economic outlook is bleaker than that of both the Eurozone and the United States. Furthermore, they anticipate that the Bank of England will enact more aggressive and rapid rate cuts compared to the European Central Bank and the U.S. Federal Reserve.

Private Sector Output Decline

According to S&P Global, September data indicates a consecutive reduction in UK private sector output, with the rate of decline accelerating to its fastest since January 2021. This decline is particularly notable as it marks the swiftest reduction in output since the lockdown period in January 2021.

Policymakers had access to this data before the Bank of England’s Thursday decision, allowing them to observe a significant cooling in inflationary pressures. Despite reports of increased costs due to higher fuel bills, input price inflation experienced its most substantial monthly decrease in 2023. Weak demand and lower cost inflation contributed to the slowest increase in average prices charged by private sector companies since February 2021. The Bank of England, in its announcement, projected a sharp decline in UK inflation over the forthcoming months.

The PMI survey also highlighted an abrupt reversal in private sector employment numbers, ending a five-month period of growth. S&P Global reported, “Aside from the pandemic lockdown months, the rate of job shedding was the fastest since October 2009. Solid declines in staffing levels were seen in both the manufacturing and service sectors, with the respective index for the latter posting in negative territory for the first time in 2023 to date.”

The cumulative impact of these developments suggests that the UK economy is slowing down, inflation is receding, and job cuts are becoming more prevalent. Consequently, wages are expected to decline in the coming months.

Consumer Confidence on the Rise

Despite the gloomy economic outlook, some positive news emerged on Friday, with reports indicating that UK consumer confidence reached a 20-month high. The latest GfK consumer confidence survey unexpectedly improved by 5 points, settling at -21 in September. This improvement holds significance for the UK economic landscape, given that the UK primarily relies on consumer-driven economic activities.

GfK attributed this positive trend to falling core inflation, higher interest rates, and increasing average weekly earnings. Although challenges remain, individuals participating in the survey expressed optimism about their personal financial situations for the upcoming year. This positive shift in the “Personal Financial Situation for the next 12 months” metric is a vital indicator of future household financial stability.

Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics, anticipates that the consumer outlook will continue to improve throughout the year. This optimism is expected to be supported by further growth in real wages, as the pace of price increases continues to decelerate. Pantheon’s calculations indicate that mortgage refinancing may exert a slight negative influence, subtracting approximately 0.2 percentage points from quarter-on-quarter growth in households’ disposable income in the third and fourth quarters of the year. However, this is not considered a decisive headwind.

In conclusion, the UK economy is facing a challenging period marked by a significant economic slowdown and declining consumer confidence, while the Bank of England is expected to respond by keeping interest rates unchanged and potentially implementing rate cuts in the near future. These developments have cast a shadow over the British Pound, leading to its recent decline in value against major currencies.