Analysts at Credit Suisse predict that the British Pound will stay reasonably well maintained versus the Euro and Dollar in the foreseeable future, partly in part due to signs that the UK economic prospects have strengthened, which should permit an additional 100 basis point rate rise by the Bank of England in 2023. However, experts at the Swiss bank assert that there is another, maybe easier, aspect to ponder when assessing the Pound: there are not many fresh sellers.

Analysts at Credit Suisse predict that the British Pound will stay reasonably well maintained versus the Euro and Dollar in the foreseeable future, partly in part due to signs that the UK economic prospects have strengthened, which should permit an additional 100 basis point rate rise by the Bank of England in 2023. However, experts at the Swiss bank assert that there is another, maybe easier, aspect to ponder when assessing the Pound: there are not many fresh sellers.

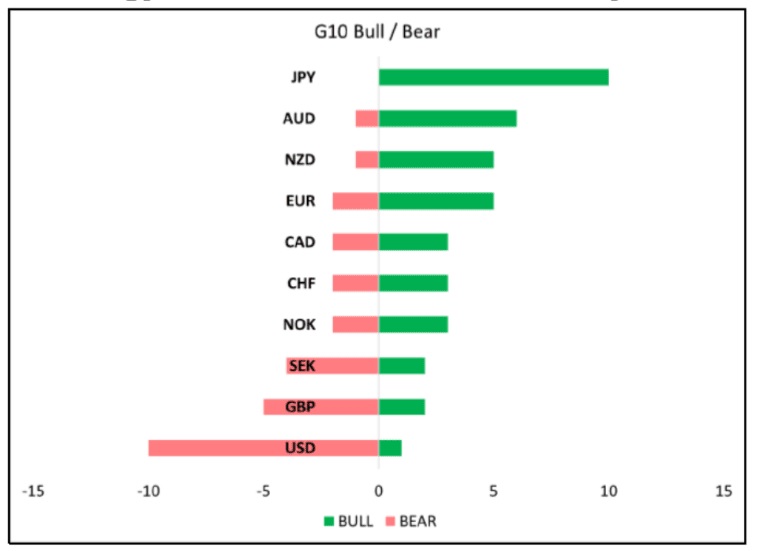

Shahab Jalinoos, Global Head of FX Strategy at Credit Suisse, explains, “With the majority of market players being GBP bears due to widely-publicized structural dangers including unending industrial acrimony, GBP appears to be keeping its terrain in portion due to the difficulty of discovering new sellers, albeit with poor data.”

A majority of market investors started 2023 anticipating another year defined by a weaker Pound: This bearish consensus for the pound hinges on another consensus view, namely that the nation’s economy will fail substantively: Recent statistics seem to indicate that these assumptions are valid.

The PMI survey data for much of January indicates a slowdown, and experts continue to predict that the UK will experience negative growth during the first quarter. The composite PMI dropped from 49.0 to 47.8, a 2-year low and below forecasts.

Aside from this, December’s budget shortfall was the biggest since modern documentation started in 1993, recording over £27 billion against consensus and OBR predictions of approximately £17 billion. Strikes in the government sector remain, despite the fact that in 2022 most working days were wasted to protests since 1992.

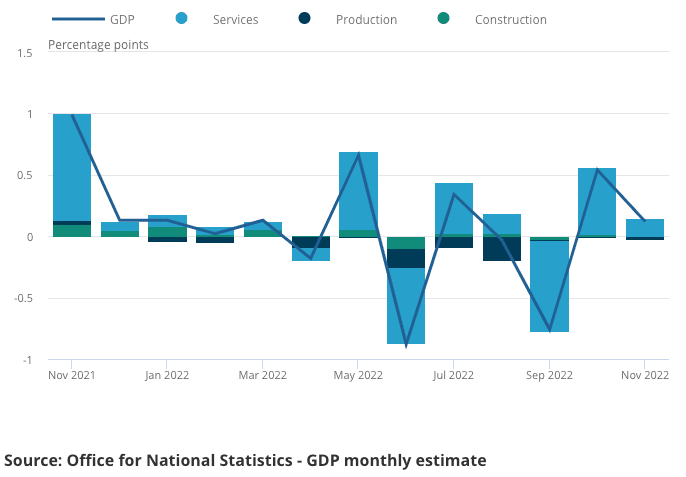

However, the consensus is ready for questioning, possibly revealing those bearish holding wagers on the Pound’s collapse. The UK’s gross domestic product grew in November, prompting experts to conclude that the economy escaped an economic downturn. This should inspire the Bank of England to improve its economic estimates for 2022 and the following year at next week’s benchmark interest rate and policy review. The GDP results were accompanied by better-than-anticipated Christmas season sales reports from the UK’s top retailers.

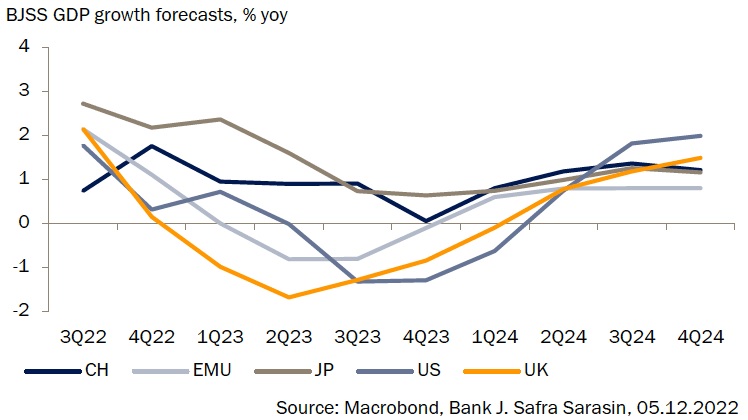

Economists at Credit Suisse have recently improved their economic predictions for the United Kingdom to -0.8% and +0.7% for 2023 and 2024, up significantly from -1.3% and +0.5% before. As worldwide energy costs decline, they highlight the durability of the services industry and the advantages of a substantial increase in trading terms.

Credit Suisse believes that the Pound to Dollar exchange rate (GBP/USD) may reach 1.2450, partly based on the notion that favorable movements in the economic outlook can also lead to a strengthening of government budgets. Jalinoos predicts that the changes will result in a “perpetual cycle of enhanced trade terms resulting in greater growth, less energy subsidies, and an enhanced budget forecast.”

The S&P Global PMI data indicated an increase in company optimism for the future year. “In spite of dropping production volumes and sluggish demand, confidence over the forecast for economic activity in the next year increased in January, reaching its highest level since May 2022. This recovery seemed to reflect optimism for a worldwide economic reversal and a further reduction in cost pressures during 2023.”

Credit Suisse asserts that the United Kingdom’s still-tight labor force and continued strong pay pressures will put the Bank of England on heightened alert for core inflationary pressures in the second half of 2023, despite the fact that the pinnacle in energy prices will enable headline inflation to decline rapidly.

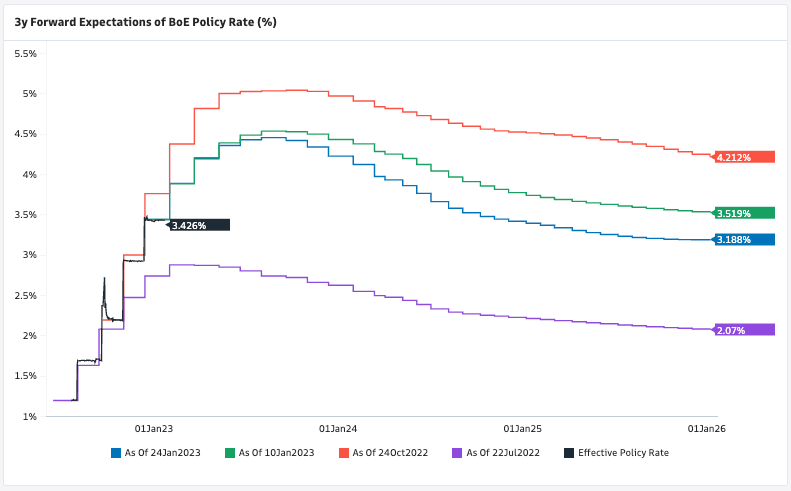

The remark comes on top of the Bank of England’s policy announcement on February 2, where markets continue to anticipate a 50 basis point rate rise, bringing Bank Rate to 4%.

However, Credit Suisse analysts anticipate that Bank Rate will peak at 4.50 percent by mid-year.

In addition, they anticipate that the Bank would maintain rates throughout the year, making a rate increase in 2023 improbable.

Pound Sterling Live reported not so long ago that investors’ forecasts for a Bank Rate decrease subsequently in the year have increased, which is congruent with the British Pound’s lack of performance.

With respect to the forecast for the Pound, Credit Suisse anticipates consistent trading versus the Euro, which should limit EUR/GBP to a range between 0.8700 and 0.8900.

Thus, the range of the Pound to Euro exchange rate is between 1.1236 and 1.15.

“Because the euro area and the United Kingdom are affected by comparable terms-of-trade and core inflationary pressures, the chance of a significant break out of the approximate zone that has persisted this year is modest,” says Jalinoos.

In the meantime, Credit Suisse feels that GBP/USD might hit 1.2450.