The GBP/EUR currency pair exchange rate has been consolidating as economic concerns of investors shift from the UK to the Eurozone following a reduction in the flow of Russian gas supplies to the bloc and against the backdrop of worries of additional prohibitions on supplies. The Eurodollar dropped to a fresh five-year low compared with the greenback and negated the latest gains against the pound sterling “after Russia utilized Bulgaria and Poland as ‘guinea pigs’ in its intimidation to close the gas tap,” opined John Hardy, Chief of Forex Strategy at Saxo Bank.

The GBP/EUR currency pair exchange rate has been consolidating as economic concerns of investors shift from the UK to the Eurozone following a reduction in the flow of Russian gas supplies to the bloc and against the backdrop of worries of additional prohibitions on supplies. The Eurodollar dropped to a fresh five-year low compared with the greenback and negated the latest gains against the pound sterling “after Russia utilized Bulgaria and Poland as ‘guinea pigs’ in its intimidation to close the gas tap,” opined John Hardy, Chief of Forex Strategy at Saxo Bank.

Russia has stated that the decision was an outcome of the denial by the two countries to settle the bill in rubles and that an identical step would be enforced on any other country that behaves in the same manner. The step taken by Russia signals its readiness to use gas supplies as a weapon and economists perceive it as a rising threat to the rest of Europe.

Hardy pointed out that Germany is in the spotlight as a total shutdown would severely affect Germany’s economic growth and force it to ration supplies.

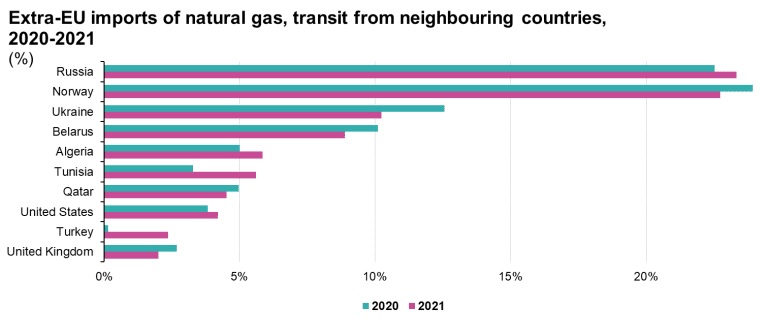

The euro plunged to 1.0514 against the greenback, the lowest level in the last five years, and also lost advances made against the pound in the last two trading sessions to reach 0.8422 once again. Russia, in general, supplies about 40% of gas bought by the EU. As the winter is officially over in Europe, households may require less gas to heat their houses. That explains why the jump in gas prices following the Bulgaria-Poland gas fiasco did not lift prices to the peak recorded in February.

Study by Berenberg Bank also indicates that Europe has consistently boosted its natural gas storage in the past few weeks to almost 36% higher than minimum levels.

Kallum Pickering, Senior Economist at Berenberg Bank, clarified that Europe will not face any gas shortage until autumn, in case of an urgent Russian blockade, enforced by the EU or Russia.

Pascal Blanqué, Chairman at Amundi Institute, has cautioned that the levels of gas storage in Europe are adequate to cater to short-term demand and a better joint initiative is required from Europe to mitigate the reliance on the Russian gas in the years ahead. Berenberg Bank has informed customers that Europe’s economy is staring at grave short-term headwinds, including supply interruptions, a rise in energy and food prices, and growing consumer wariness.

According to Pickering, since November last year, the Eurozone appears to have been stuck in a state of stagflation, with low growth and excessive inflation. In the second quarter, the Eurozone is expected to remain in stagflation due to the existing challenges. He further stated that an abrupt halt of gas supply from Russia to Europe could drive the continent into recession.

The pound was beaten a weak back on the release of a series of data that signaled a slowdown of the UK economy, but the focus of investors has turned towards the Euro in the last few trading sessions. Dominic Bunning, Chief of European FX Research, HSBC Bank plc, stated that the euro continues to stay under tremendous selling pressure with the latest stimulant for sell-off being the turn-off of gas supply to Poland and Bulgaria.

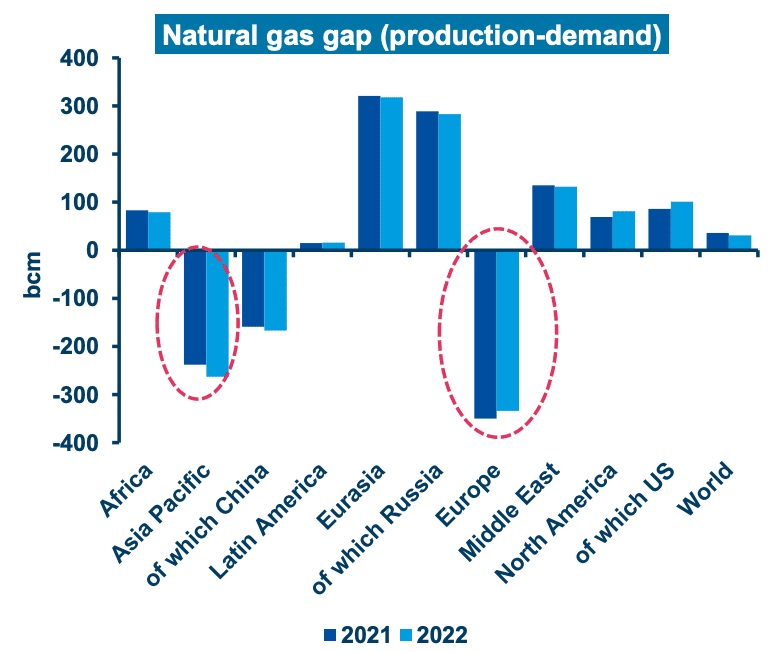

Bunning believes that the above-mentioned scenario is adding momentum to gas prices in Europe while aggravating the disturbing growth-inflationary pressure combo that has been worsening at a rapid pace since the beginning of 2022. The analyst also points out that the supply-demand disparity related to natural gas was already in a heightened state in Europe and the Asia Pacific before the start of the conflict.

Blanqué further opined that the geopolitical repercussions of the conflict, considering Russia’s position in supply, are enormous, including increased prices and a possible danger to supply, both of which support the inflation argument.

Jeremy Stretch, a strategist at CIBC Capital Markets, has stated that the prevailing doubts regarding gas supplies to Eastern Europe is threatening the already weak macro view of the economy. The Euro will probably stay vulnerable with more gas payments due date to come, making investors vigilant of further supply blockages.

Risks to the Russian gas supply sparked a roughly 15% surge in the European gas prices last Thursday. Stretch opined that the euro’s ability to withstand shocks will be tested if the gas price rises further and question the Eurozone economic recovery saga.

Worries over the Eurozone economic guidance are being mirrored by a major indicator of the Eurozone condition: the spread in the yield between the German and Italian bonds.

Fawad Razaqzada, Market Analyst at City Index and Forex.com, has pointed out that the differentials between the Italian and German 10-year bonds have reached the highest level since June 2020.

He further stated that the European macro data released in the last few days was unimpressive. The German Gfk consumer sentiment index was -26.50, missing analyst forecasts of -16.10. Likewise, data published by the INSEE indicated that the consumer confidence index in France inched lower to 88, from 90.

However, the Eurodollar seems to have been oversold against the greenback currently and the dead cat bounce is expected to be used for profit booking in the short term. Anyway, this will not be the only factor that is going to push GBP/EUR pair lower as GBP/USD also seems to be technically oversold and gaining momentum to make a temporary reversal. In the weeks ahead, analysts are however cautious of the Euro’s horizons considering its susceptibilities to the Ukraine conflict and Russia’s aggressiveness.