According to some experts, the Dollar will find it difficult to prolong a multi-month uptrend as the market appears to have reached ‘maximal hawkishness’ in its estimates of future Federal Reserve interest rate increases, while others question the concept that the US currency invariably falls after the initial increase of the rate hike cycle. Both the Federal Reserve (Fed) and the Bank of England (BoE) raised interest rates earlier last week, and the Greenback and the Pound are lagging behind the other G10 currencies.

According to some experts, the Dollar will find it difficult to prolong a multi-month uptrend as the market appears to have reached ‘maximal hawkishness’ in its estimates of future Federal Reserve interest rate increases, while others question the concept that the US currency invariably falls after the initial increase of the rate hike cycle. Both the Federal Reserve (Fed) and the Bank of England (BoE) raised interest rates earlier last week, and the Greenback and the Pound are lagging behind the other G10 currencies.

However, the Pound has maintained its gains versus the Dollar, indicating that the Pound-Dollar pair is now more concerned with prospects for prospective Fed rate rises. In what quantifies to a frenzied effort to normalize regulation in the midst of soaring inflationary pressure, the Fed is on track to hike interest rates six additional times in 2022, far more than BoE.

This policy trajectory, nevertheless, has been sufficiently telegraphed, implying that foreign currency markets were ‘costing it in’ much before the Fed took off with just a 25 basis points boost on Wednesday. The Dollar, which has been among the best performing currencies in the last year, has pushed higher as a result of the rise in prospects.

Bipan Rai, North America Head of FX Strategy at CIBC Capital Markets, differed by saying “With respect to the Fed, the market has reached a point of ‘record high hawkishness.’ Can the US Federal Reserve raise rates seven times in2022? Most likely, however the market has already factored it in.”

The prospect of increased benchmark rates at the Fed, which would boost bond yields and enhance investments into US financial assets, was one part of the Dollar’s multi-month streak of gains versus Sterling and rest of the key currencies. Markets would prefer to see more rate rises factored into the foreseeable for this scenario to continue.

Rai stated “Is it possible to go any further? Perhaps not, given the current state of public opinion. This is most probably why the STIR and equities markets surged following Powell’s presser, while the USD tanked. In terms of price, we’ve passed the critical threshold.”

According to the Fed’s forecasts, there will be seven rate rises in 2022r and nearly four in 2022, with the midpoint rate finishing at 2.8 percent. Following the Fed’s March policy choice to raise interest rates and warn that as much as six more rises are anticipated to happen in 2022, the Pound to Dollar exchange rate returned over $1.31. On Monday, the currency pair was as low as 1.29.

The weakening of the dollar reinforces some experts’ assumptions that the market has successfully soaked the Fed raise predictions trade, resulting in declining rewards for Dollar bulls.

Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole “The US dollar stays as the G10’s high-yielding, safe-haven monarch. However, the market action after the March FOMC session has shown that the USD’s rising rate advantage has its limitations in terms of supporting the currency globally.”

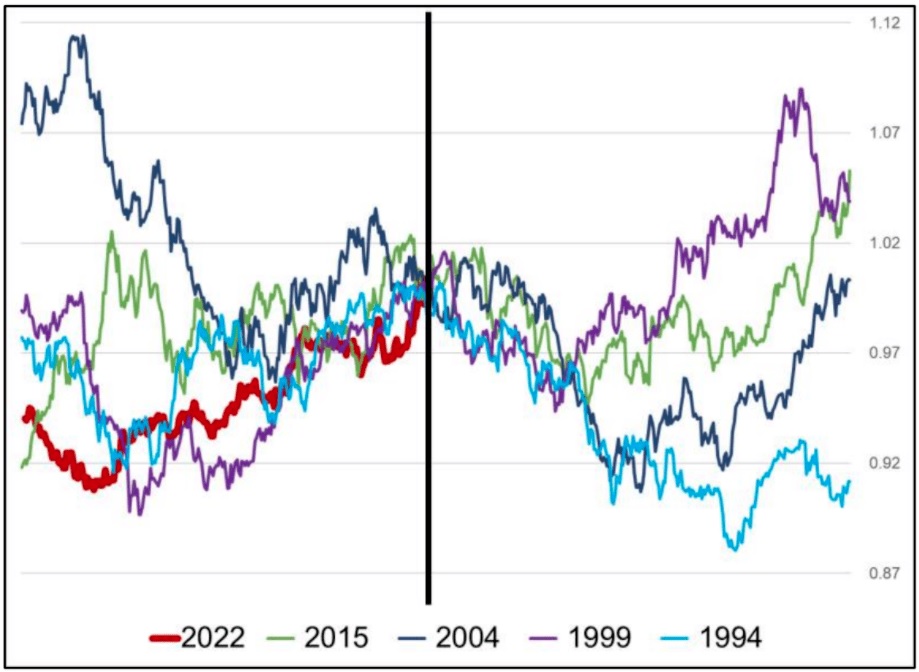

Nevertheless, other experts are referring to the Dollar’s record high propensity to devalue after the initial rate rise in a Fed rising cycle.

Adam Cole, Head of FX Strategy at RBC Capital Markets, said “After the dollar’s inability to appreciate in the aftermath of the week’s unmistakably hawkish FOMC, a popular financial truism that suggests sell USD on the initial Fed rate increase is gaining traction.”

Brent Donnelly, CEO of Spectra Markets, said “On the initial Fed rate rise, history suggests selling the dollar. It’s a four-person sample set, so it’s obviously not a verifiable fact or whatever, but it’s reasonable. It’s a typical example of buy the rumor, sell the truth.”

Cole, on the other hand, warns against revisiting the notion that the Dollar would act in the same way it has previously.

Cole said “Although this would have remained true on average over several Fed rate hike cycles, the situation surrounding the rate cycle’s flip has been so varied that the mean is useless.”

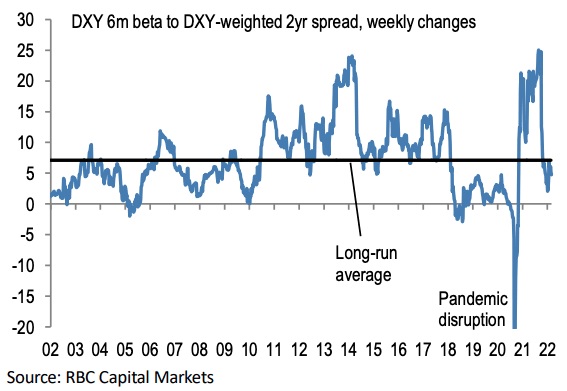

According to RBC Capital research, the Greenback has been unresponsive to rate disparities in the past twenty years, but there has not been a time when its beta has been consistently negative.

“This is not to say that we should be positive on the dollar when the tightening cycle begins, but instead to cast doubt on simplistic rules of thumb related to the long averages of restricted historical information.” says Cole.

The persistent market uncertainty tied to Ukraine seems to be another important factor in the Dollar’s rise. The safe haven,as investors show nervousness, dollar is an obvious beneficiary, and as far as the conflict continues, vulnerability in the world’s reserve currency will be greeted with backing.

Uptrend in the Pound-Dollar currency exchange rate would certainly be restricted in these kind of circumstances; the fact of the matter is that Sterling is among the indisputable G10 losers of the Ukraine conflict.

Chris Turner, global head of markets and regional head of research for UK & CEE at ING, said “There’s a school of thought that claims the dollar sells down in the initial half of the year of a Fed tightening cycle, based on the ‘buy-the-rumor, sell-the-fact’ attitude of a well-publicized tightening process. What makes this occasion distinct, in our judgment, is the Fed’s impending severe front-loading tightening and the developments in Ukraine, which have harmed European economic outlook and will impact on regional currencies.”

In a research note, Turner and colleagues wrote “In summary, we believe the US dollar will remain bought versus the euro and the yen on falls, while commodity-exporting currencies will thrive.”

Nevertheless, the conflict has supported commodity price inflation, extending an era of strong worldwide inflationary pressures that threatens to limit global economic development. Because the Dollar is an anti-cyclical currency, it surges when the world economy is ailing and the underlying background continues to favor the Dollar.

Cole said “The truth is that each tightening cycle is unique, and also how the USD reacts is determined by a variety of variables such as global strategy, why the Fed is hiking benchmark rates, and how effectively rises have been factored into forecasts before they occur.”

Cole said “It does not imply that we must be USD optimistic after the initial increase, but when the lifting cycle has begun, there really should be no default stance of USD softness.”