As per recent research from BMO Capital Markets, the UK’s evolving trade agreement with the EU and the rest of the region might be beneficial to the British Pound. BMO Capital Markets continues to prefer the Pound over the Euro from a tactical point of view.

As per recent research from BMO Capital Markets, the UK’s evolving trade agreement with the EU and the rest of the region might be beneficial to the British Pound. BMO Capital Markets continues to prefer the Pound over the Euro from a tactical point of view.

New data shows a “geographical change occurring,” according to Stephen Gallo, European Head of FX Strategy at BMO Capital Markets, and this supports his opinion that the Pound is a bargain against the Euro on downturn.

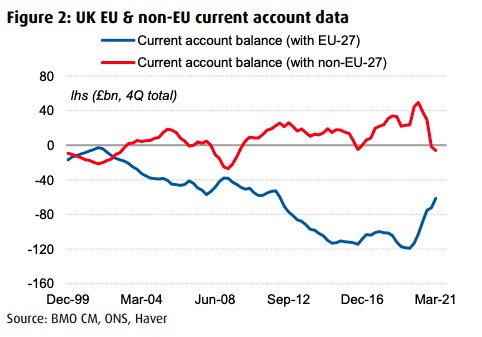

The call on the Pound-to-Euro exchange rate comes as a reaction to the ONS’s publication of first-quarter Balance of Payments information, which indicated that the UK’s current account deficit had narrowed – a fundamentally positive factor for the Pound.

The Balance of Payments (BoP) is basically the United Kingdom’s bank account with the rest of the globe; a key component of this dynamics is the BoP’s current account, which has typically been in deficit due to the UK’s necessity to import goods.

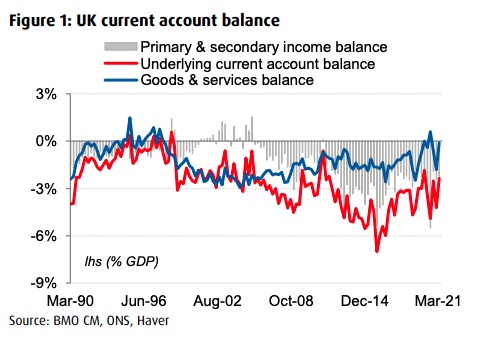

According to the ONS, the UK’s current account deficit with the EU has decreased from £22 billion in the first quarter of 2019 to barely £7 billion. A significant cause of the fall, according to Gallo, is a 33% decline in EU goods and services imports. Imports from outside the EU have decreased by something like 20%. “A portion of the abrupt drop is due to COVID-19-related distortion. For example, the sharp drop in UK services imports from the EU (approximately £12 billion) since 2019 is linked to a drop in vacationers from the UK” Gallo agrees.

“However, the 13% difference between the two numbers is still fascinating,” he says, “and it might be connected to persistent adjustments in the regional flow of commerce, especially because the variations are apparent in merchandise trade as well.” The appeal comes as Nissan unveils a huge new investment in its Sunderland factory, which will result in the creation of 6000 job vacancies. The projects will see the construction of a new ‘giga factory’ to produce batteries, as part of Nissan’s attempt to ‘onshore’ as many of the modules used in car production as practicable.

This is partially because, under the rules of the UK’s trade pact with the EU, the percentage of UK-made modules in automobiles built in the UK must start to go up from 2024. This indicates that industrial activities that were previously performed in Europe or elsewhere may be needed to transfer to the United Kingdom, therefore increasing local production capacity. “We believe there is a reorganization occurring that will favor the GBP in the long run, from both a BoP and domestic economic development standpoint,” Gallo adds.

With the lifting of Covid prohibitions, data shows that UK exports to the global economy have rebounded faster than those to the EU, rising by 1.0% in the first quarter vs a 15% decrease to the EU. “The decrease in the UK’s total trade deficit (above) might be an early signal that participation in the EU’s customs union was a disadvantageous arrangement for the UK, but more data is needed to make a definite conclusion,” Gallo writes. The current account, nevertheless, is not just determined by trade in commodities and services: capital movements related to investment play a considerable role as well.

Gallo expects more interesting advancements, which might have an impact on where the Pound trades in the following months. According to BMO Capital, the EU accounts for around 40% of the total stock of UK financial assets parked overseas, while the UK’s non-EU financial assets have provided far higher income (credits) for UK investors over the previous decade. It’s too early to say what the post-Brexit investment landscape in the UK will seem like.

“However, we expect the government’s efforts to harness long-term capital via pension and insurance overhaul to contribute to a change in the structure of financial account transfers away from loans and deposits and toward ‘stickier’ types of capital (i.e. portfolio investment and FDI),” Gallo adds. Chancellor of the Exchequer Rishi Sunak launched a study regarding investment regulations for pension systems to improve the economy in the post-Covid era in the March 2021 Budget. As per budget papers, this consultation will look at whether specific expenses under the 0.75 percent charge ceiling have an impact on pension plans’ capacity to diversify in a wider variety of assets.

The objective is to guarantee that pension funds are not deterred from making such investments and can provide the “best returns to investors.” “The macro environment appears to be continuing to provide challenges for EURGBP topside, and we’d prefer to recommend selling rallies in this pair,” Gallo adds. Nevertheless, analysts are not unanimous in their optimism about the UK’s trade and payments patterns, with Samuel Tombs of Pantheon Macroeconomics predicting that the country’s current account deficit would expand in the months ahead. According to Tombs, the current deficit will grow considerably and will most probably go up over last year’s 3.5% average as a percentage of GDP.

As per Tombs, the current deficit will widen significantly, likely exceeding the 3.5% average of last year as a percentage of GDP. “For starters, the United Kingdom’s import demand is rather responsive to price increases—note that there was no import substitution following sterling’s large devaluation in 2016—suggesting that higher costs for manufactured products and raw materials will raise the import bill,” Tombs adds. In terms of the UK’s export standing, Tombs believes that new trade restrictions with EU nations, particularly in the services sector, will stymie the country’s rebound.

If capital inflows to the UK dried up, the current account imbalance would constitute a driver of weakness for Sterling.